2011年12月3日星期六

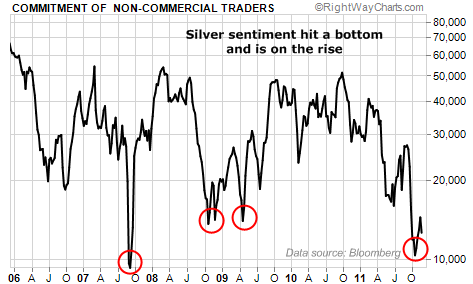

Non-Commercial COT Indicating Silver Preparing for Big Move Up?

In the wake of the MF Global collapse/ silver confiscation, the commitment of non-commercial traders plunged from nearly 30,000 to 10,000- the second lowest total of the bull run to date. The only time sentiment has been more negative among non-commercial traders was in October of 2008, when silver was smashed all the way to $8.

Does the recent bottoming in non-commercial traders COT indicate we have seen another long term bottom in silver, and prices will soon be MUCH HIGHER than the low $30's level that silver has been consolidating in?

From the 2008 bottom near $8, with the corresponding bottom in the non-commercial COT of 10,000, silver gained 63% in the next 6 months to $13/oz, 125% over the next 12 months to $18/oz, and placed a 3 bagger over the next 24 months to $24.50 by Oct of 2010. A similar move from $31 over the next 2 years would put silver near $100 by November of 2013.

訂閱:

發佈留言 (Atom)

1 則留言:

useful notes

發佈留言