The chaos in gold is typical. Already, the hate mail has begun. “Stop the Bullshit” one said because demand in Shanghai is at record highs.It takes far more than one country to make a bull market. Others just blame me for the decline because they just listen to those who always say buy. The New York institutional press would NEVER dare quote me because I stand up and expose their favorite sons – the NY bankers. The Goldbugs do their best to make sure their press does not quote me since they only have a litany of people who say buy – buy – buy! So why is it always me?

People are so married to this idea of the entire world collapsing and only gold will rise it is truly astonishing. What is the problem? Why must gold be the exception to everything? This is not a religion. It is a market. I hate to tell you but everything on a timing level was on the mark. The collapse in the stock market during the Great Depression was 34 months. The rally in gold was 34 months. These are reoccurring timing frequencies in times of crisis. This is about making money and surviving – not punishing the world because you are not on the top of the food chain. I am not selling anything. I am not soliciting funds for management. It always is what it is. Nothing more!

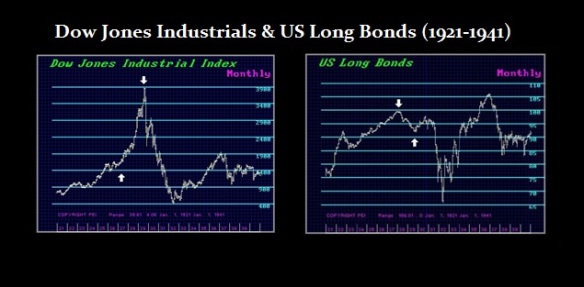

People have been sold pure nonsense on so many fronts. The talking heads claim lower interest rates are bullish for stocks. Just do the correlation and you will see that when rates plummet as during the Great Depression or after 2007, stocks fell. So precisely where does this nonsense emerge? Who writes this bullshit for the talking heads?

The precious-metals investors have been sold the similar nonsense – all hype and no substance that gold will rise because the Fed increases the money supply. A very simple one-dimensional relationship that NEVER works because we live in a DYNAMIC world economy. Bull markets ONLY take place when that object is rising in terms of ALL currencies. They have also been sold the nonsense that gold rises with inflation. That was a great sales pitch, but it is time to do the REAL correlation. When you do the analysis rather than preaching dogma and chanting mantras laced with rhetoric, strangely what emerges is NOT that gold rallies with inflation, but it rallies when people DO NOT TRUST the government! Just do the correlation and you may be surprised.

The release of the January meeting minutes of the Federal Reserve’s policy committee show that members of the Fed were concerned that it might be hard to reel in all this liquidity. Keep in mind, that very concern assumes power to reverse such trends. Even Herbert Hoover point out in his memoirs that proved to be yet another false assumption. The Fed policy committee recognized that the liquidity itself may end up contributing to instability in financial markets. Why? They see the Dow off to test the 2007 highs. They are afraid there could be a bubble, yet at the same time they are confronted by a contracting economy. They are clueless as to what is going on. When asked what was their contingency plan in case the Euro broke apart, they said that would never happen so there was no plan. That is like putting up a building without fire exits because you clearly had no intention of setting the building on fire. Consequently, the irony confronting the precious-metals investors is that this may mean the Fed will curb its expansionary monetary policy SOONER than expected. Thus, gold plummeted for the sales pitch became the mover in reverse – buy for inflation, sell for deflation.

This may be the fundamental that shakes the weak longs out of the tree, and melts the icing off the cake. Nonetheless, it is just rhetoric. Gold will rise NOT because of hyperinflation that will NEVER take place. Gold will rise as the Sovereign Debt Crisis unfolds. Understanding the difference prevents losses like today.

It is NOT the inflation that we need to be concerned with long-term, it is the implosion of DEFLATION. Unfortunately, when you are in a Sovereign Debt Crisis as took place in 1931, capital contracts and hoards because people are confused and they will spend barely nothing until the sort out what is really unfolding.

Gold will rise NOT because of hyperinflation, but because of the Sovereign Debt Crisis and the lack of a place to put money. The dollar is rising because you have NO place to put big money. Europe has no federal bond issue. Japan is a basket case, and China has no bond market of any size. Thus, the US bond market remains it. This is why 30 year mortgages have just dropped below 4% and banks are now trying to lend mortgages as they see liquidity increase (not from the Fed but capital inflows).

It is so important to understand the global fundamentals for NO market, not even gold, is ever driven by a single fundamental or a single country. It is at all times a global affair.

Armstrongeconomics.com

沒有留言:

發佈留言