The gold to silver sales ratio was 19.5/1 in April, fell to 80/1 in July and so far in August it is a staggering 489/1! Over the last month, investors are overwhelming purchasing nearly 500 times as many Silver Eagles as Gold Eagles from the US Mint!

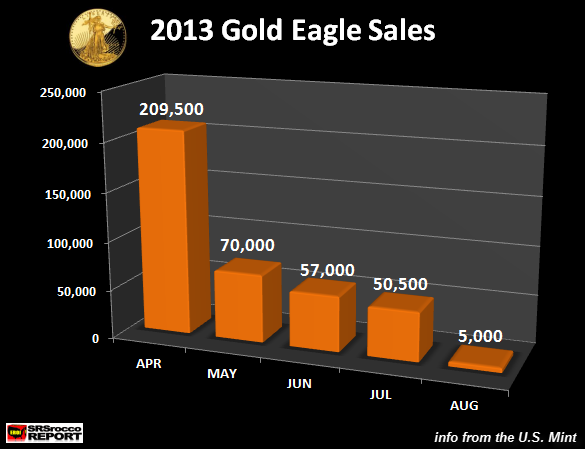

If we take a look at the chart below, we can see that sales for Gold Eagles declined from 209,500 oz in April down to only 50,500 in July.

Furthermore, sales really dropped off a cliff so far this month as the U.S. Mint only reported that 5,000 oz of Gold Eagles were sold. Possibly, the U.S. mint has not updated their gold eagle sales figures this past week, but as we can see the trend is much lower.

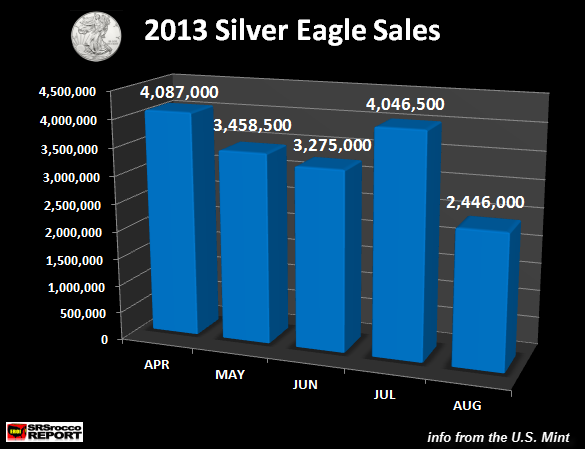

However, Silver Eagle sales are stronger than ever. Here we can see that after the second take down in the price of gold and silver in June, investors purchased 4,046,500 Silver Eagles in July almost surpassing April’s total of 4,087,000.

The gold to silver sales ratio was 19.5/1 in April, fell to 80/1 in July and so far in August it is a staggering 489/1. We will have to wait and see the updates for the end of the month, but I would imagine it will turn out to be at least 100/1… which means investors are overwhelming purchasing 100 times as many Silver Eagles as Gold Eagles.

Silver Eagle Sales to Hit Several New Records

Silver Eagle sales are on track to surpass the total sales for 2012 within the next 2-3 weeks. I forecast that total sales for Silver Eagles by the end of August will be 33 million oz. Of course, we could see a bit more.. or less depending how the U.S. Mint updates its records.Because the U.S. Mint now updates on every Monday, the next will be on August 26th and then the following Monday will fall on September 2nd. So it looks like they just may dump the last week sales of August on the first week in September which would make the sales quite larger as there are 5 Monday updates that month.

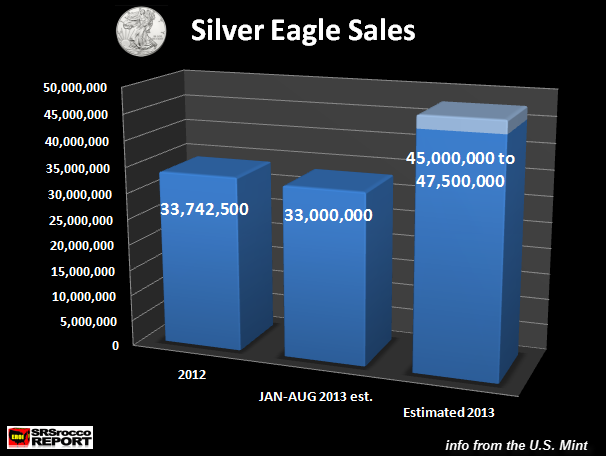

This last chart shows that the Silver Eagle sales during the first 8 months of the year nearly surpassed the total for 2012:

Again, I am estimating that the total sales for JAN-AUG, 2013 will be 33 million, but we may see a bit less due to the way the U.S. Mint updates its figures. Regardless, Silver Eagle sales will be greater in the first or second week of September compared to the total in 2013.

Furthermore, Silver Eagle sales will hit a new all-time record this year by beating the past record set back in 2011 of nearly 40 million oz. I believe total Silver Eagle sales in 2013 will reach 45-47.5 million. The average monthly rate (excluding Jan) has been approximately 3.6 million ounces (Feb-July). This turns out to be 14.5 million oz for the last four months of the year. If we add 33 mil oz. + 14.5 mil oz we come up with 47.5 million oz.

On the other hand, if we take a conservative approach and attribute say a monthly 3 million oz, then the total for 2013 may be 45 million oz. Either way, its 12-19% more than 2011′s record.

Lastly, if we look at the current trend in Gold & Silver Eagle sales, we can see that investors are purchasing silver as a premium investment over gold. I believe the gold-silver ratio for Eagle sales in August will be north of 100/1. Even though both precious metals are at very low prices, Hedge Funds and investors are banking on much better future returns in silver than gold.

NOTE: I will be publishing a Q2 2013 update on the Break-Even cost for the Top 12 Primary Silver miners next week when the final company reports its earnings.

沒有留言:

發佈留言