After selling most of his stock in Barrick Gold Corp. in the second quarter, billionaire investor George Soros more than doubled his remaining holding in the mining company.

Soros Fund Management LLC bought 1.78 million Barrick shares in the third quarter, taking total holdings to 2.85 million, according to a regulatory filing. The fund rebuilt its stake in Barrick, one of the world’s two largest gold producers, after selling 94 percent of its holdings in the second quarter to cash in on the stock’s best first-half performance ever.

The billionaire investor’s purchase comes after Barrick began steps to cut costs and sell assets to lower its debt. The Toronto-based producer reported third-quarter earnings that topped analysts’ estimates even as gold prices posted their first quarterly decline this year.

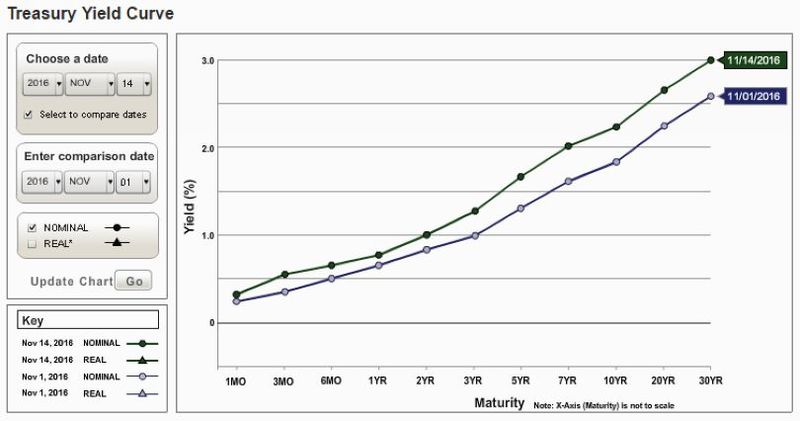

Barrick shares have fallen to a seven-month low of C$19.86 as haven demand for gold wanes amid prospects of rising U.S. interest rates. Bullion has slipped more than 7 percent since June, in part because of speculation that U.S. President-elect Donald Trump’s pledge to increase infrastructure spending will widen the deficit and boost yields, hurting the appeal of non-interest bearing gold.

“The Barrick train keeps chugging as the company’s continual focus on lowering the cost per ounce of gold produced is paying off, positioning it well for the long term,” Bloomberg Intelligence analysts Kenneth Hoffman and Sean Gilmartin said in an Oct. 27 report.

Barrick has lowered its net debt to below $6 billion for the first time since 2011, according to the BI note.