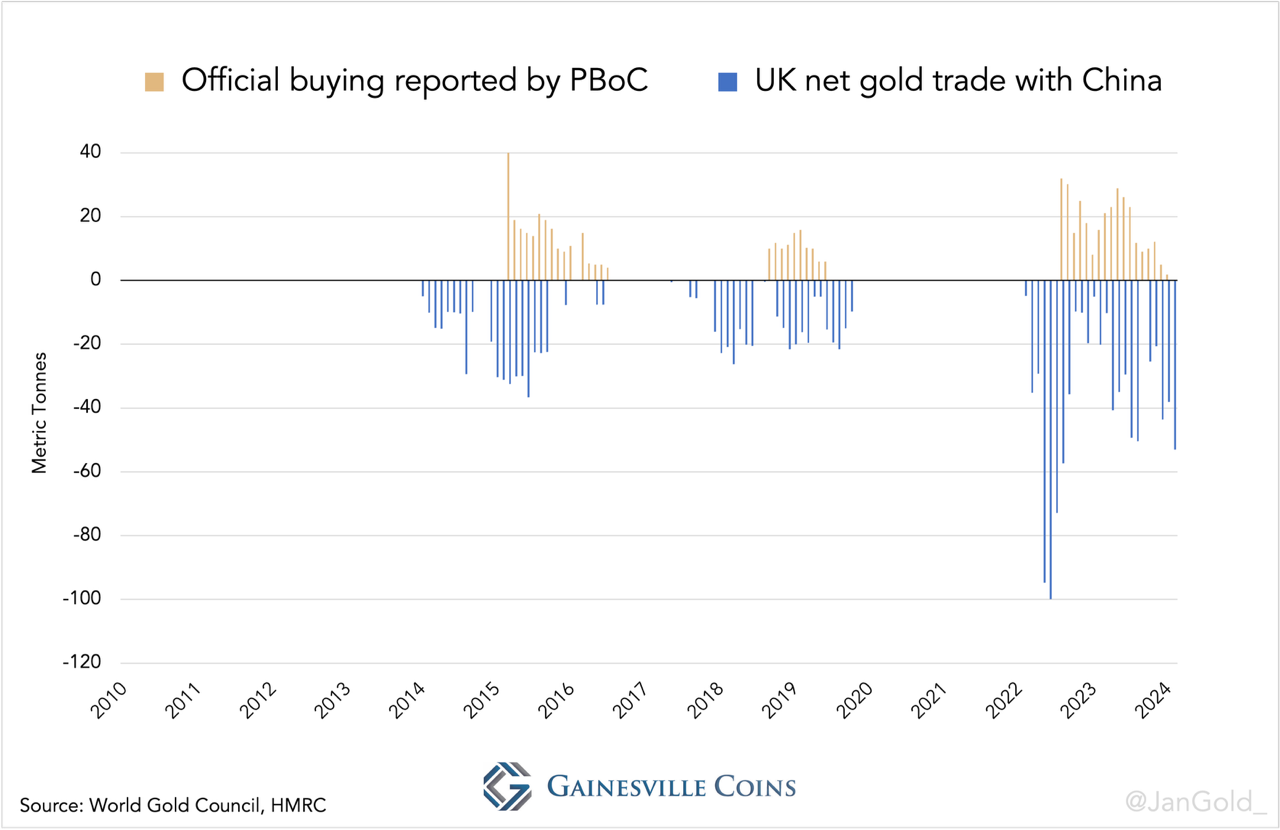

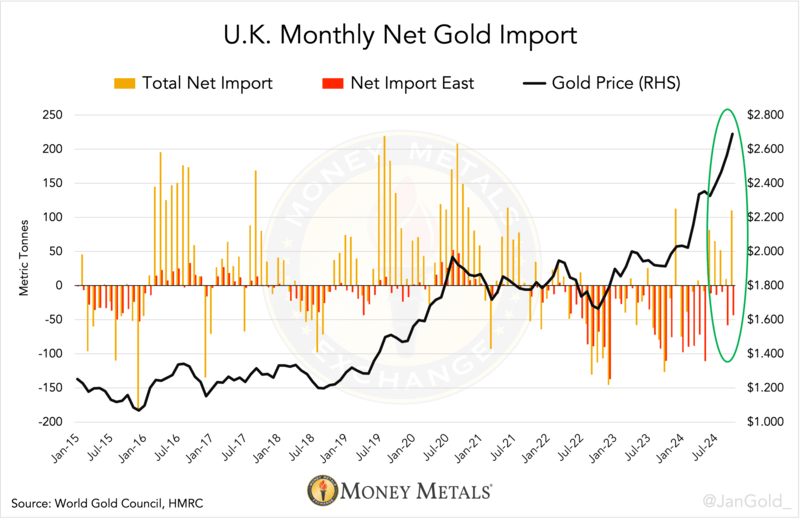

While 99% of the media keeps staring at official data by the Chinese central bank (PBoC)—misleadingly stating it added 5 tonnes of gold in November following a supposed six-month pause—the PBoC’s "unreported" purchases in London accounted for a stunning 60 tonnes in September and another 55 tonnes in October.

And while cross-border trade statistics from the U.K. for November have yet to be released, I foresee another purchase of a similar magnitude.

Chinese authorities see a greater role for gold in the future international monetary system, or they wouldn’t continue buying such extraordinary amounts of gold. Via London alone, the PBoC has stockpiled 1,000 tonnes of gold since Russia’s foreign exchange assets were “frozen” by the West early 2022.

London Exports to China Are a Proxy for PBoC Buying

Since July this year, I have been writing that a large share of China’s gold imports into the domestic market is not bought by the private sector. We can conclude that the bars exported from the U.K. to China are secretly destined for the PBoC.

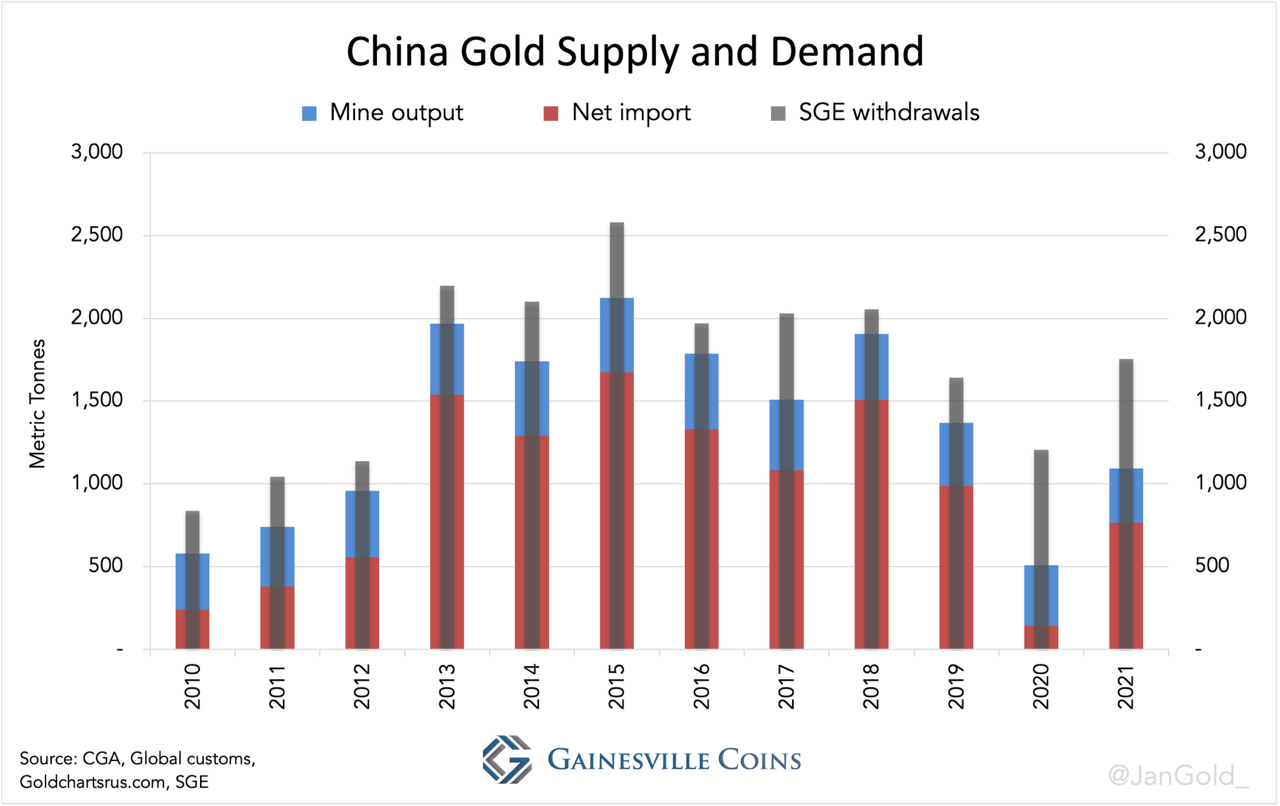

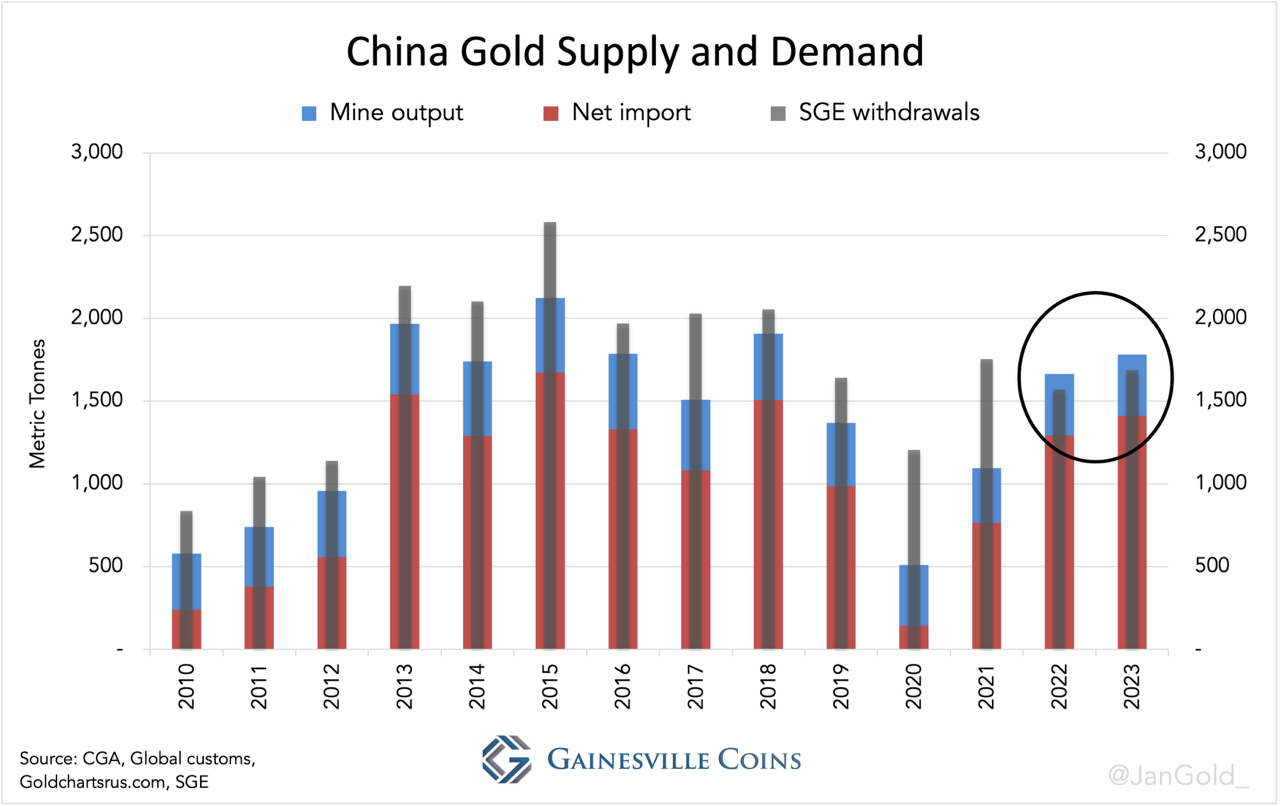

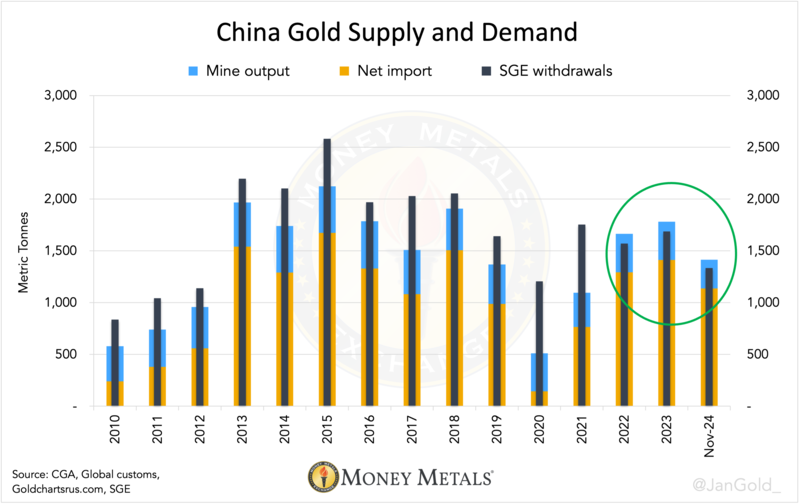

Initially, I based my analysis on a pronounced surplus in the Chinese domestic gold market—resulting from supply (mine, recycled gold, and imports) outstripping demand. The most conceivable explanation for this surplus is that the central bank of China is behind large gold imports.

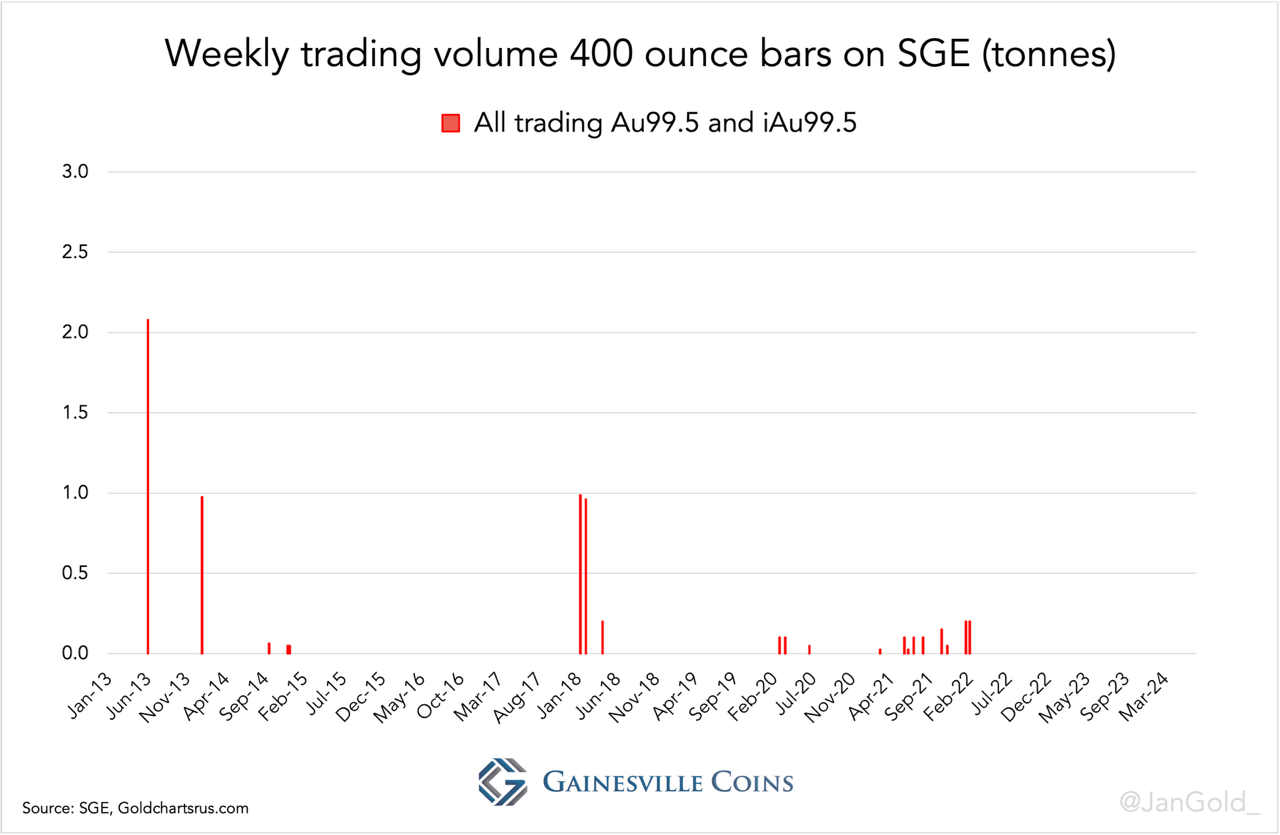

Chart 1. From 2022 until November 2024 there is a surplus in the Chinese gold market, because import and domestically mined gold was more than SGE withdrawals.

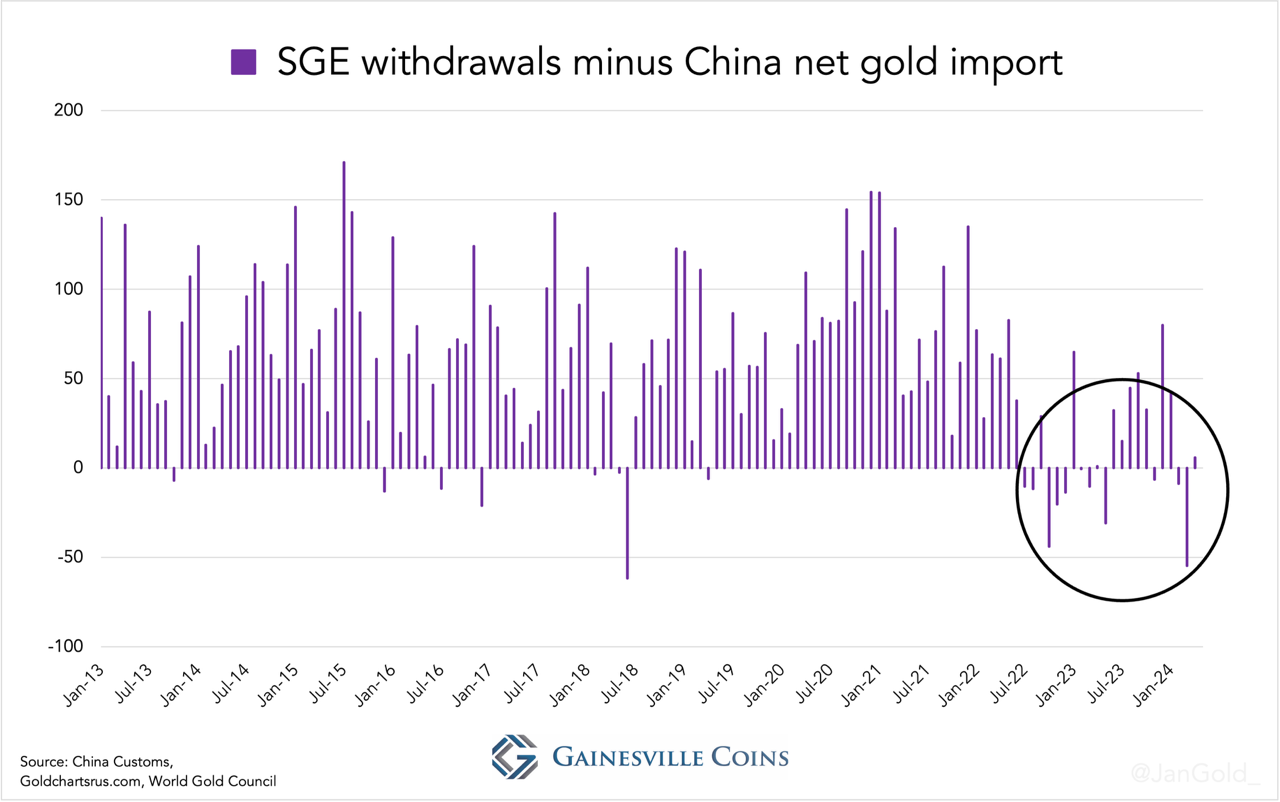

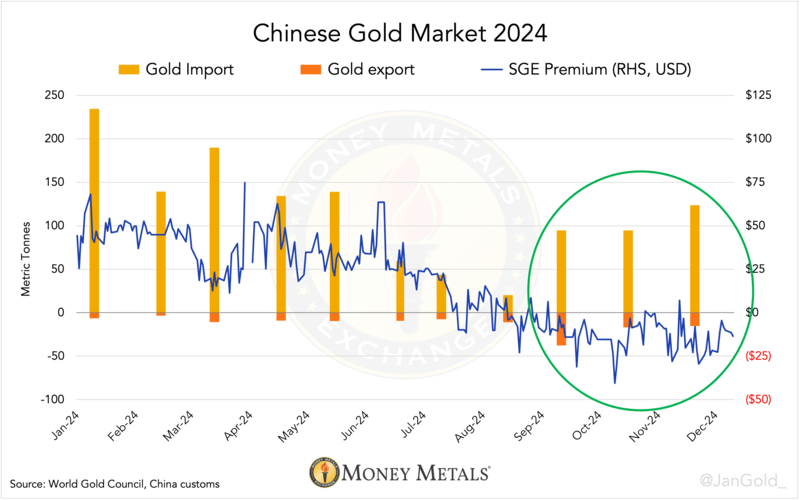

My findings became more evident when in September the premium on the Shanghai Gold Exchange (SGE) turned negative, but Chinese gross imports accounted for a sturdy 95 tonnes for the month.

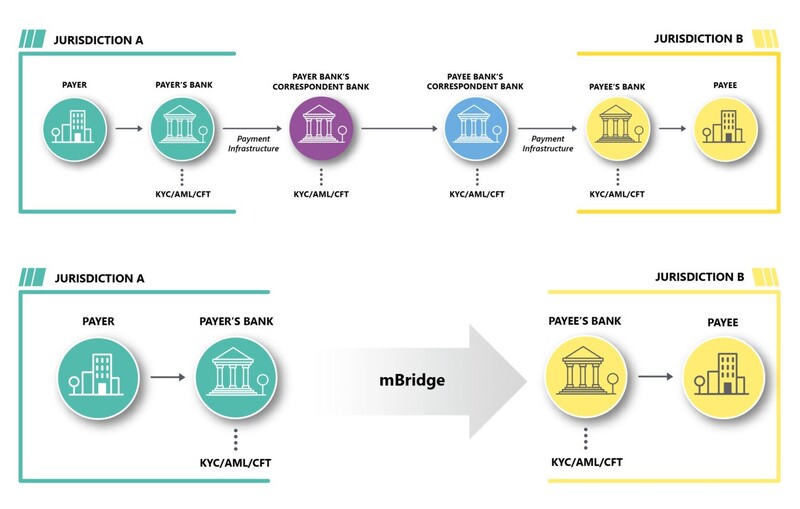

It makes no economic sense for any bullion bank to buy gold abroad and sell at a loss at the SGE. The 60 tonnes (in 400-ounce bars) exported in September from the London Bullion Market to China went to the vaults of the PBoC in Beijing, I therefore concluded.

The PBoC Keeps Up the Pace, Buying 55 Tonnes in October

I noted the following in my last article:

…we can see that in October, the SGE was trading at a discount while imports reached 95 tonnes, which was the same as in the prior month. I strongly suspect the PBoC was secretly buying gold in London again.

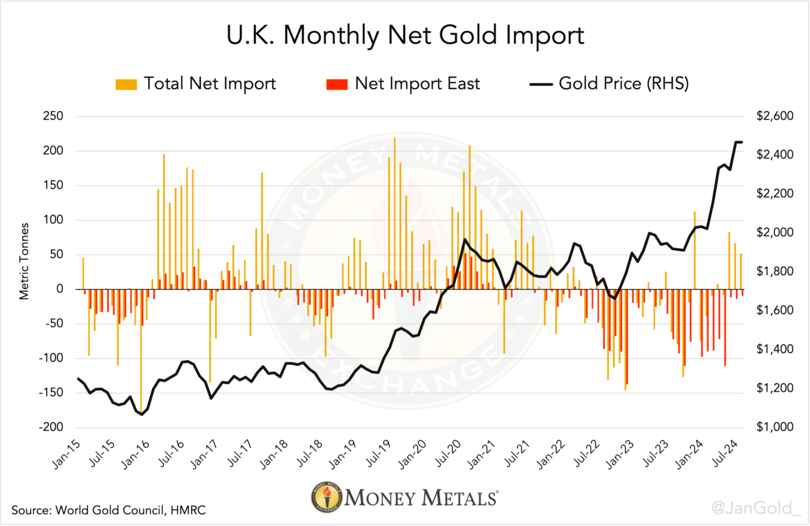

Recent data by Her Majesty’s Revenue & Customs (HMRC)—Britain’s tax, payments and customs authority—reveal 55 tonnes were indeed dispatched from the London region to China in October.

Meanwhile, it’s likely the PBoC also bought gold elsewhere. Total imports into the Beijing region accounted for 69 tonnes in October, as per General Administration of Customs People's Republic of China. That’s 14 tonnes more than what was shipped from London.

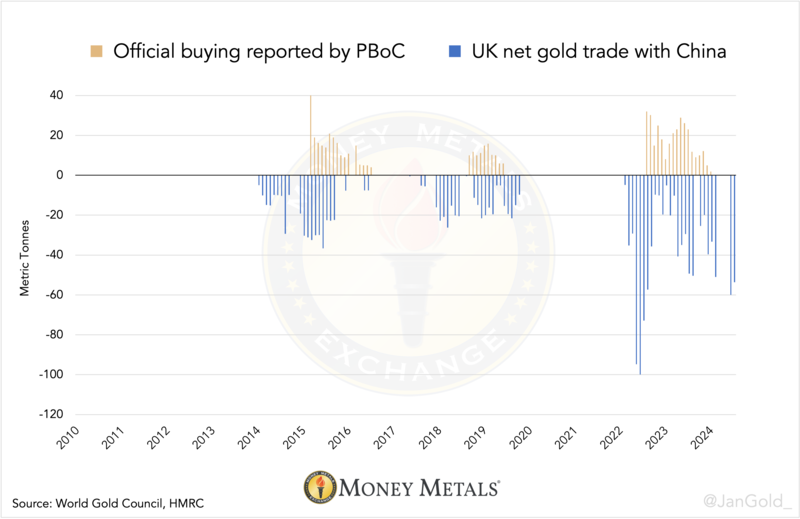

An illustration I shared previously is a chart of the PBoC’s publicly disclosed gold purchases versus U.K. gold exports to China. The chart shows both are loosely correlated "although the PBoC usually takes up to a year to publicly report its acquisitions and keeps about 65% of it hidden" (quote from my article from November 26, 2024).

Chart 3. The PBoC’s publicly disclosed gold purchases versus U.K. gold exports to China that serve as a proxy for covert buying by the Chinese central bank.

Only two months after September (when the PBoC covertly resumed buying in London), it revealed to the world it bought a mere 5 tonnes in November. Even this fraction of the truth boosted sentiment in the gold market. Go figure.

The Chinese central bank is currently buying at least ten times more gold than what you read in the newspaper, and yet markets got excited based on mere breadcrumbs!

Goldman Sachs Writes on PBoC Gold Buying in London

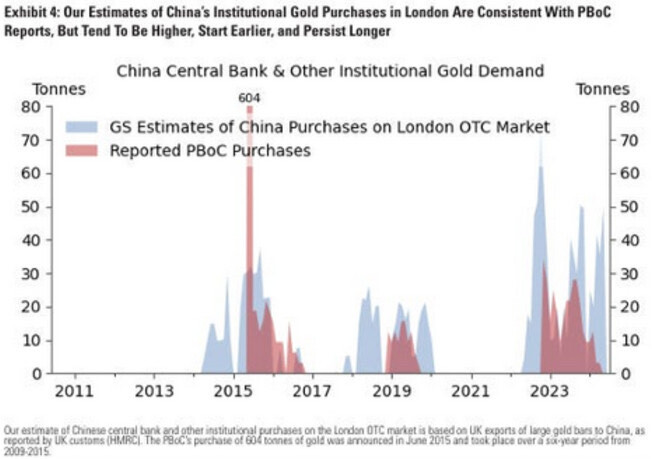

Meanwhile, my research is gaining traction as it was picked up by Goldman Sachs (GS). Below you can see a chart by GS displaying what I first demonstrated in July, but with a different design.

Chart 4. Courtesy of Goldman Sachs.

At the bottom it reads "our estimate of Chinese central bank … purchases on the London OTC market is based on UK exports of large bars to China, as reported by UK customs (HMRC)." (Parroting my own conclusion.) Eventually other media will start writing about these huge purchases as well.

For me, this topic reminds me of my early work analyzing SGE withdrawals. In 2013, I began spotlighting the volumes of gold withdrawn from SGE vaults, documenting why that is a proxy for Chinese wholesale demand. By implication, gold demand in China at the time was twice what consultancy firms stated. A few years later, nobody argued about the meaning of SGE withdrawals anymore.

Gold’s Role in the International Monetary System Will Increase

In November, gold on the SGE was still trading at a discount, yet Chinese gross gold imports swelled to 122 tonnes. No doubt the PBoC struck big in the London Bullion Market once again.

Chart 5. The Chinese central bank orders gold abroad at bullion banks and outsources transport to Beijing to those banks, making them have to register the metal at customs.

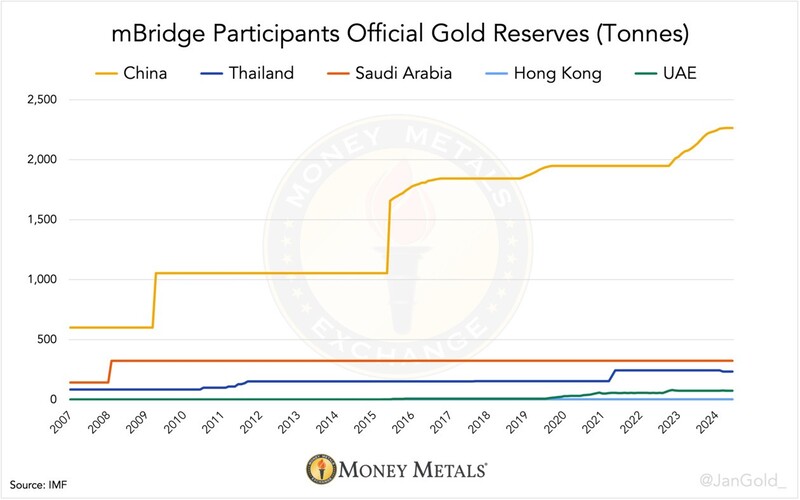

My latest estimate of the PBoC’s true gold holdings is roughly 5,000 tonnes, a number that is in stark contrast to what the Chinese divulge to the IMF, i.e. 2,271 tonnes. (I will substantiate my estimate in a follow up article.)

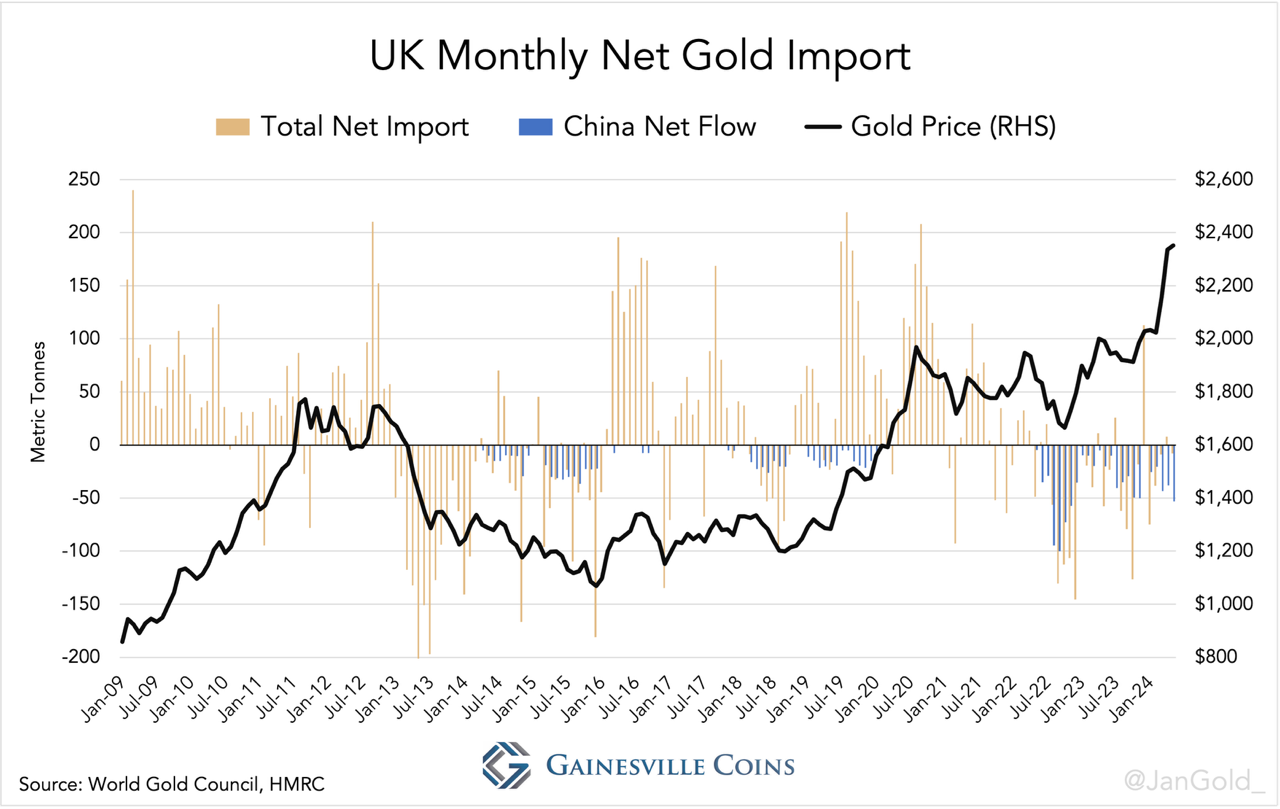

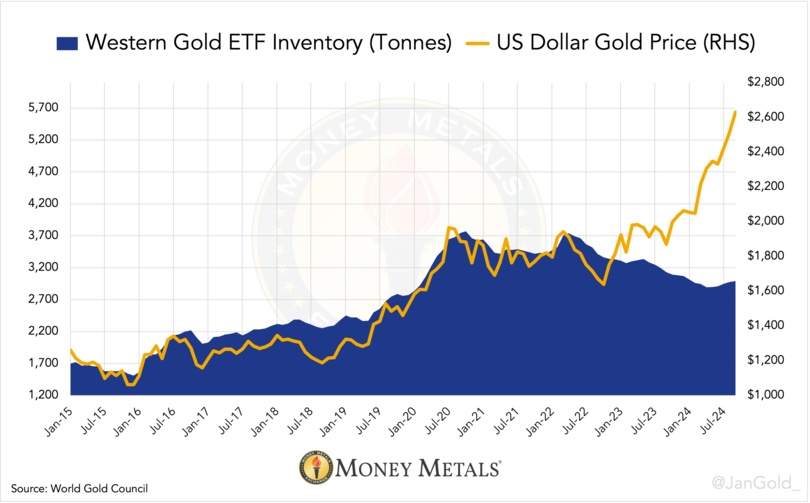

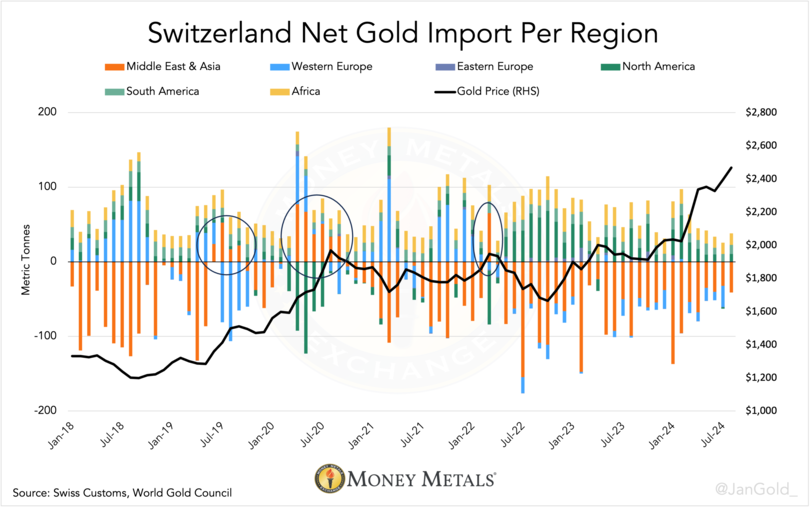

Tellingly, it seems some large investors in the West are sniffing out the momentous developments in the gold market. Although the U.K. was a gross exporter of 55 tonnes to China in October, the U.K. itself net imported 110 tonnes.

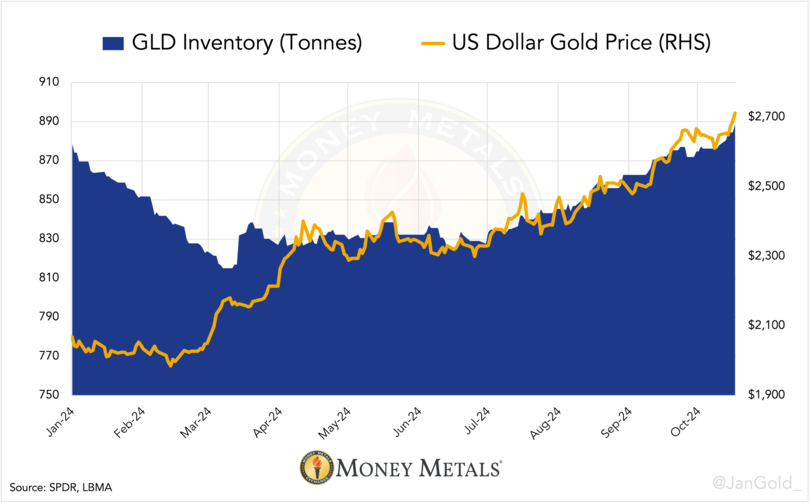

Who bought? Most likely institutional money as ETF holdings stored in London increased by only 18 tonnes, according to statistics compiled by friend and data wrangler Nick Laird from GoldChartsRUs.com.

Chart 6. Western institutional money must be buying gold too, because London inflows are substantial. As an aside, HMRC’s numbers show mostly mining countries exported to the U.K. (Australia, Canada, Kazakhstan, South Africa, United States, Uzbekistan), next to Germany, Singapore, and Switzerland.

These are exciting times indeed for gold.

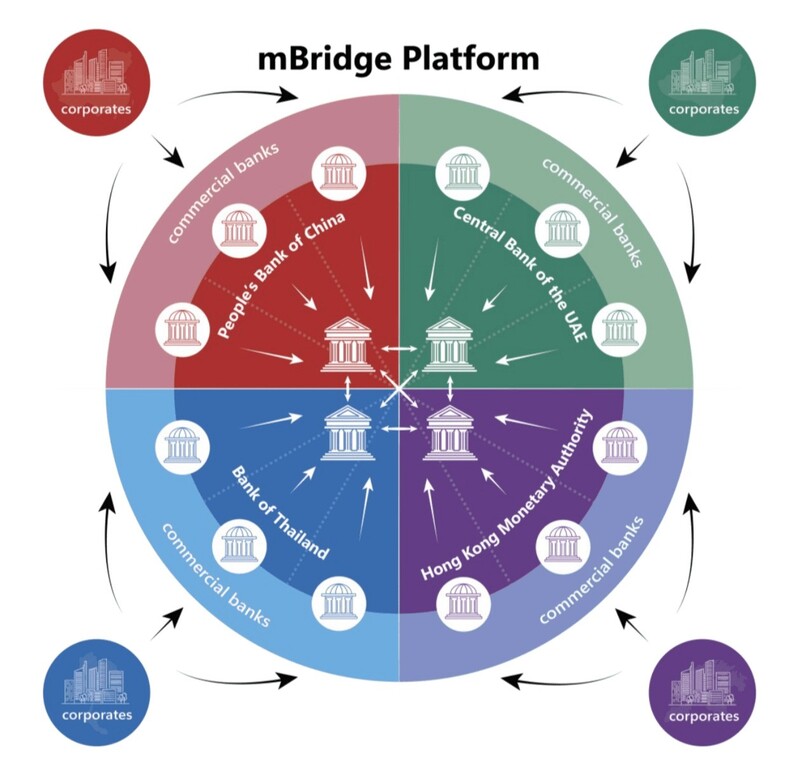

China’s monetary authority doesn’t buy gold for no reason at a pace of approximately 60 tonnes a month from Great Britain alone—now 1,000 tonnes in total since the war in Ukraine. The Chinese obviously see a greater role for gold in the international monetary system going forward.

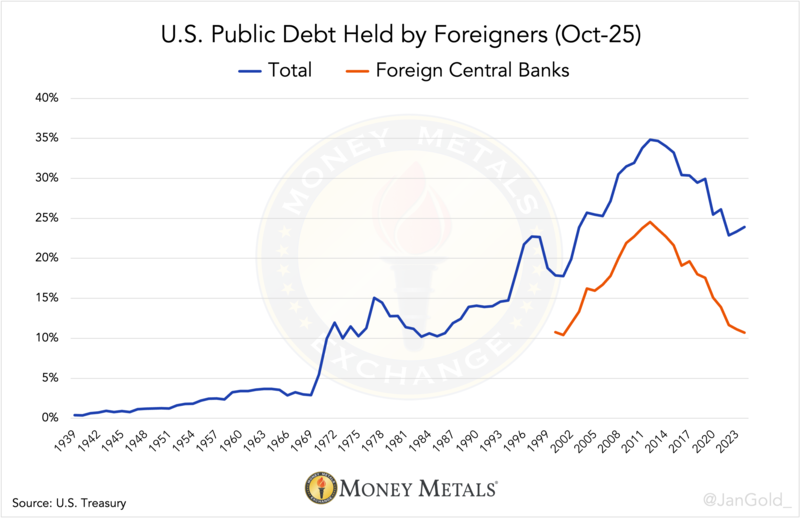

Over the same 30-month period, the value of China’s holdings of U.S. Treasuries has declined by $250 billion.

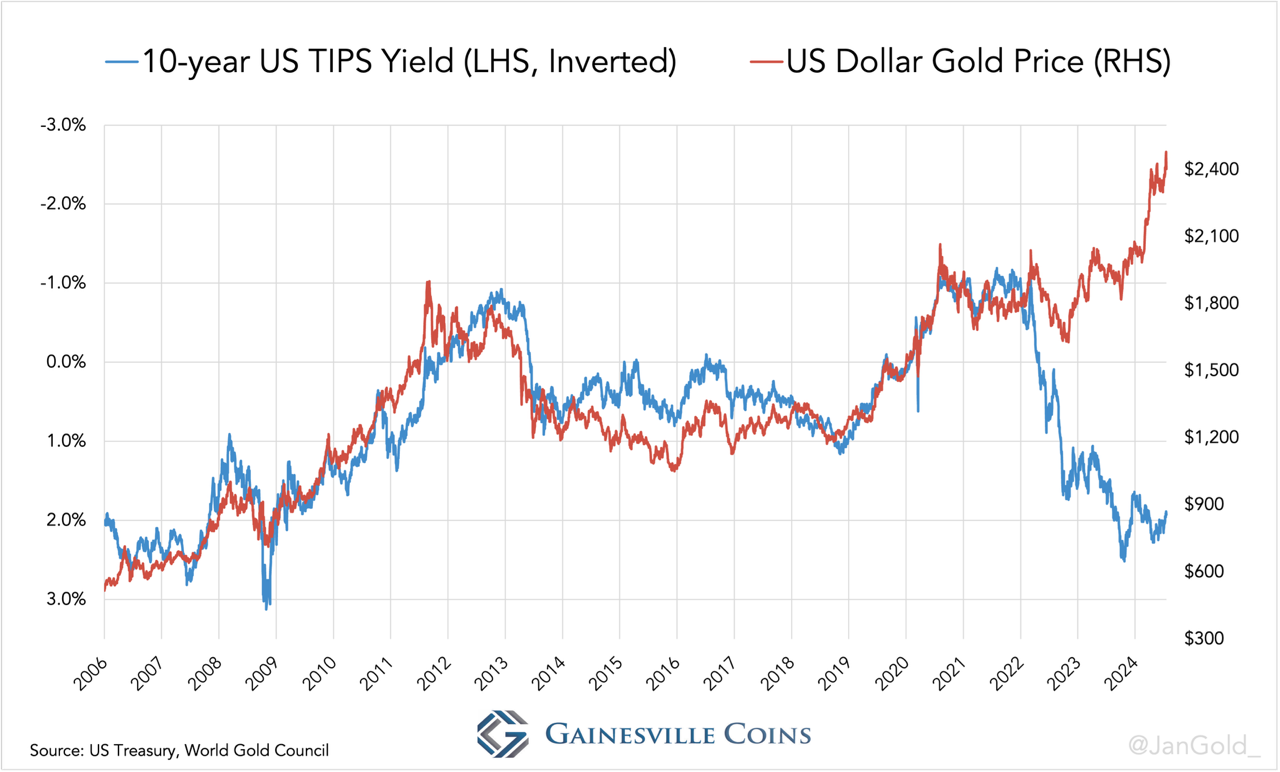

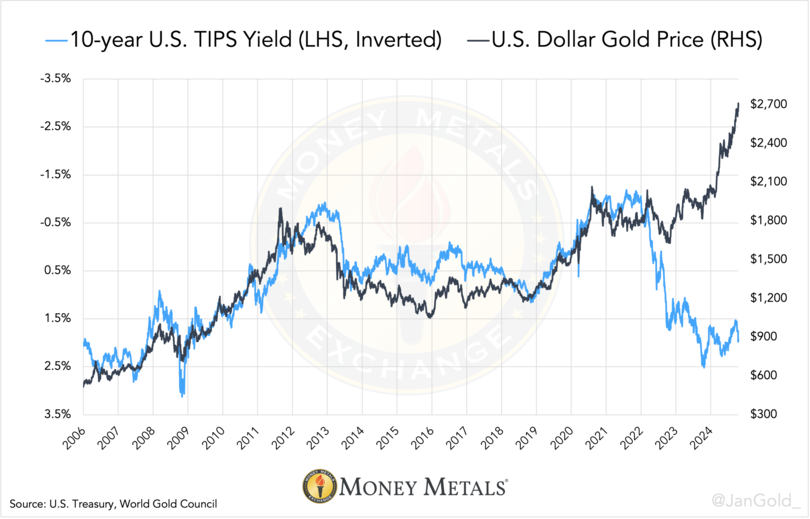

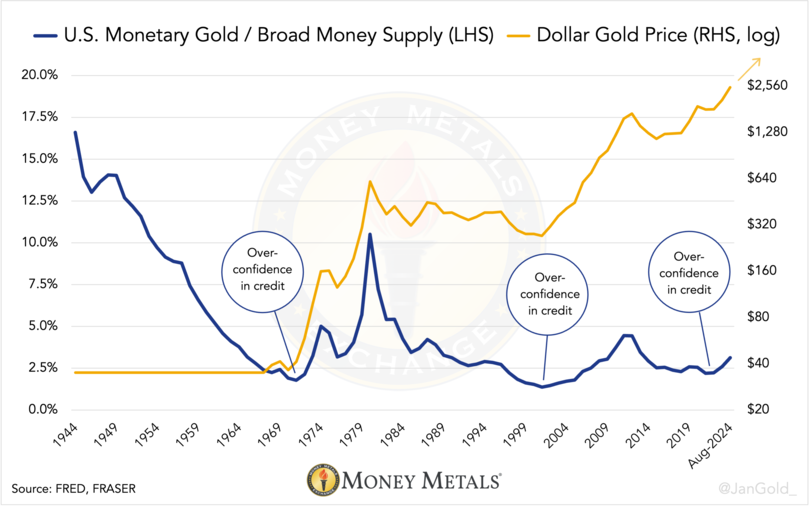

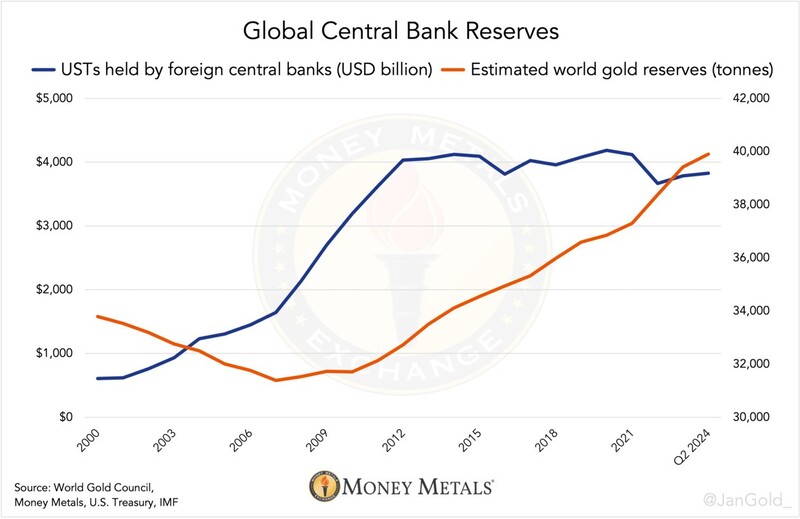

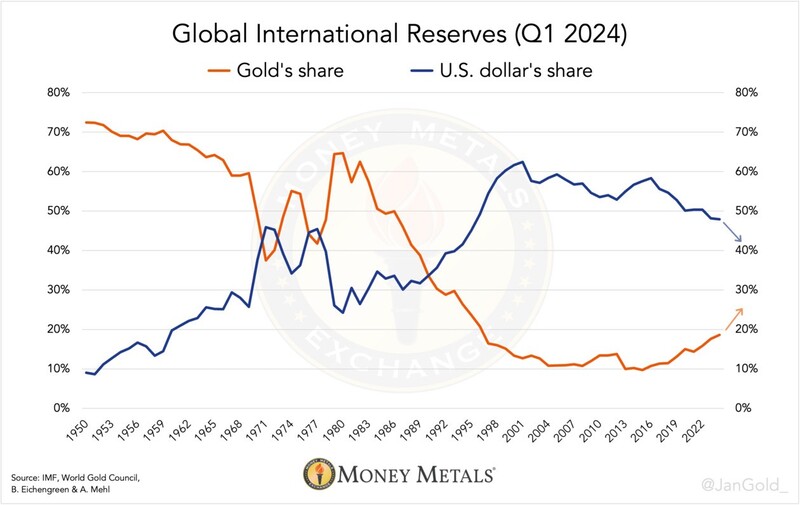

What we’re witnessing a shift from "dollar recycling"—the status quo from 1971 through 2021—to "gold recycling." Instead of investing trade surpluses in dollars, countries are increasingly choosing for gold.

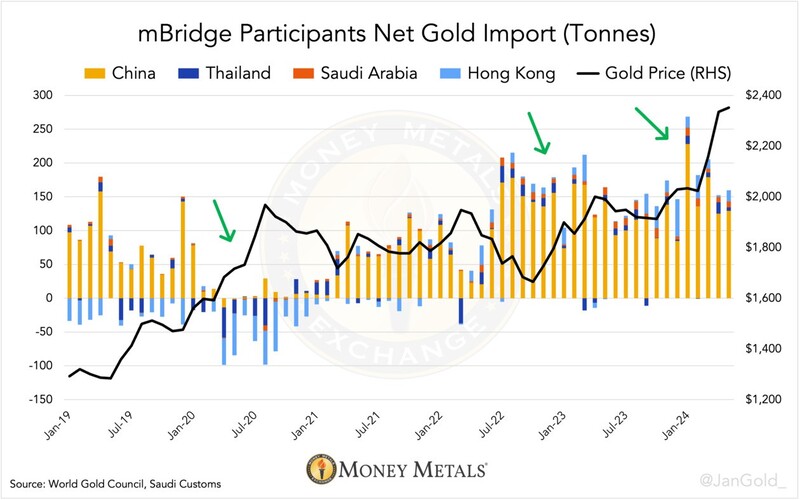

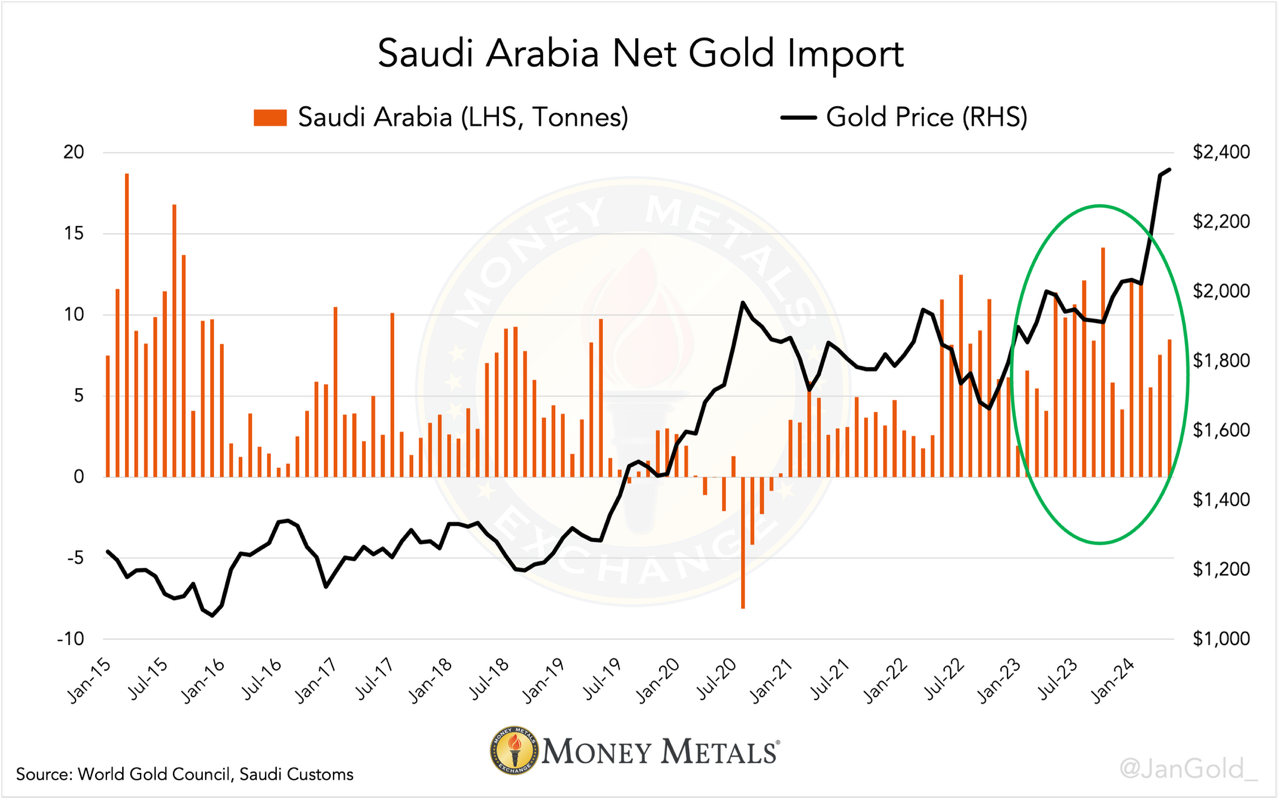

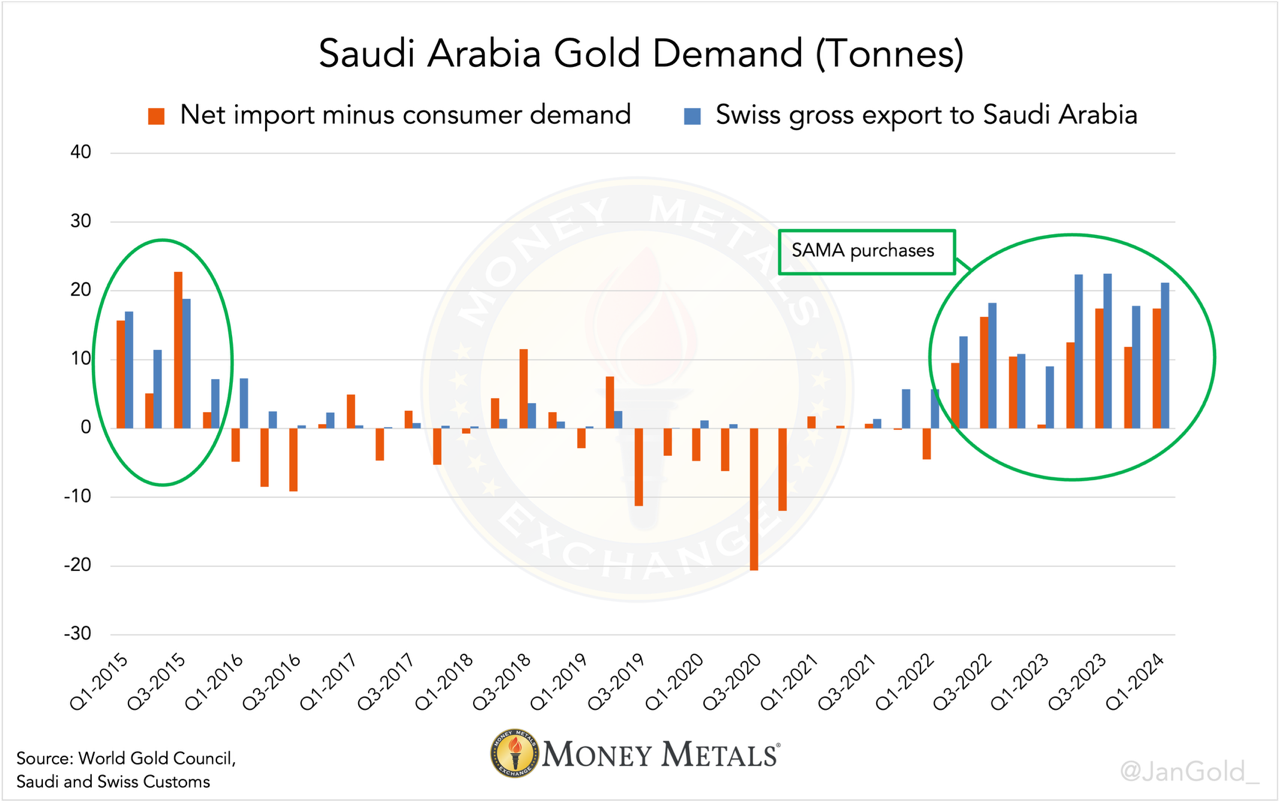

The Saudi central bank is also buying gold under the radar, next to many central banks buying openly.

As a result, less and less of the U.S. its excessive public debt (122% of GDP) is financed by foreigners, let alone foreign central banks. This forces Treasury to either reduce the fiscal deficit (currently 6% of GDP, good luck!), pay higher interest rates and accelerate the debt spiral, or print its way out of this through inflation.

In addition to dollar weaponization, the (global) debt overhang is a motive for central banks to increase their gold reserves, as historically inflation is the most common big way of restructuring debts.

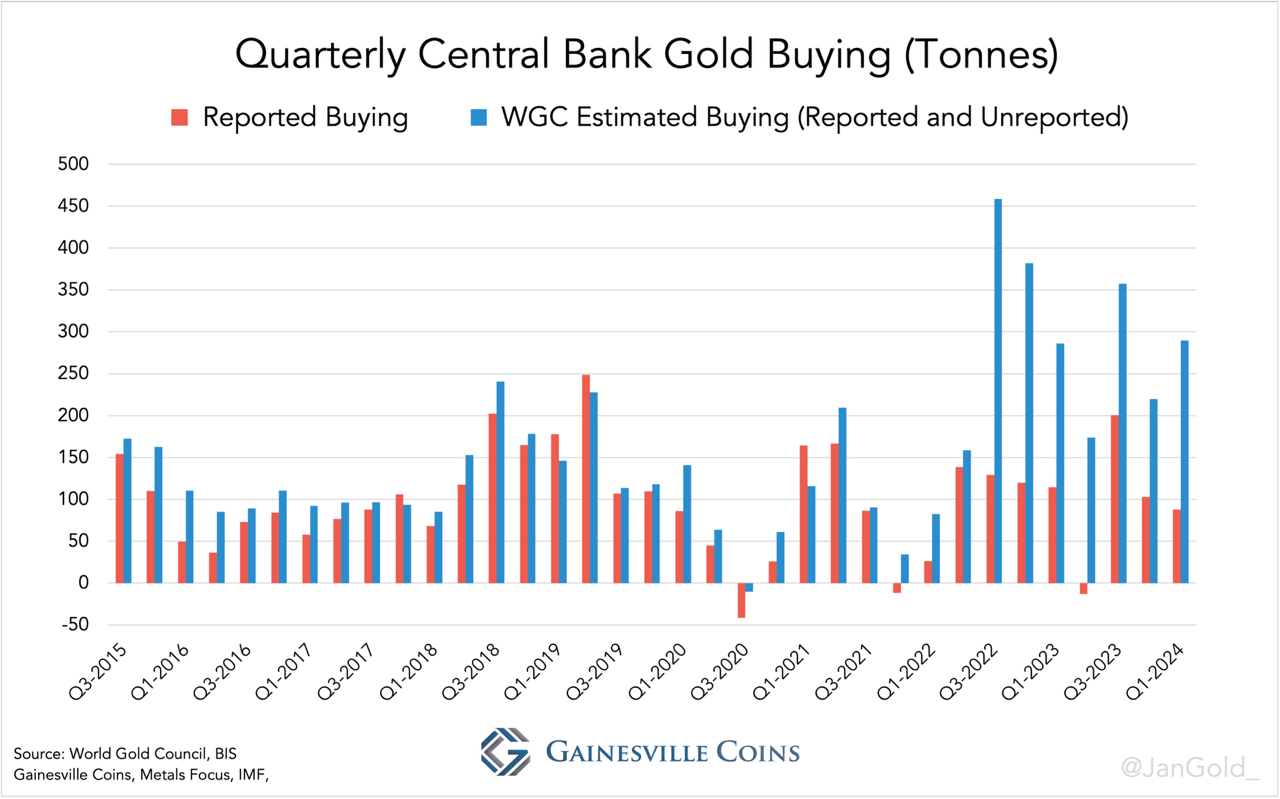

As

the chart above reveals, when the gold price went up (2016, 2017, 2019,

and 2020), the Saudis cut back imports or became net exporters. Since

2022, however, the gold price has escalated, yet Saudi Arabia continued

to import gold.

As

the chart above reveals, when the gold price went up (2016, 2017, 2019,

and 2020), the Saudis cut back imports or became net exporters. Since

2022, however, the gold price has escalated, yet Saudi Arabia continued

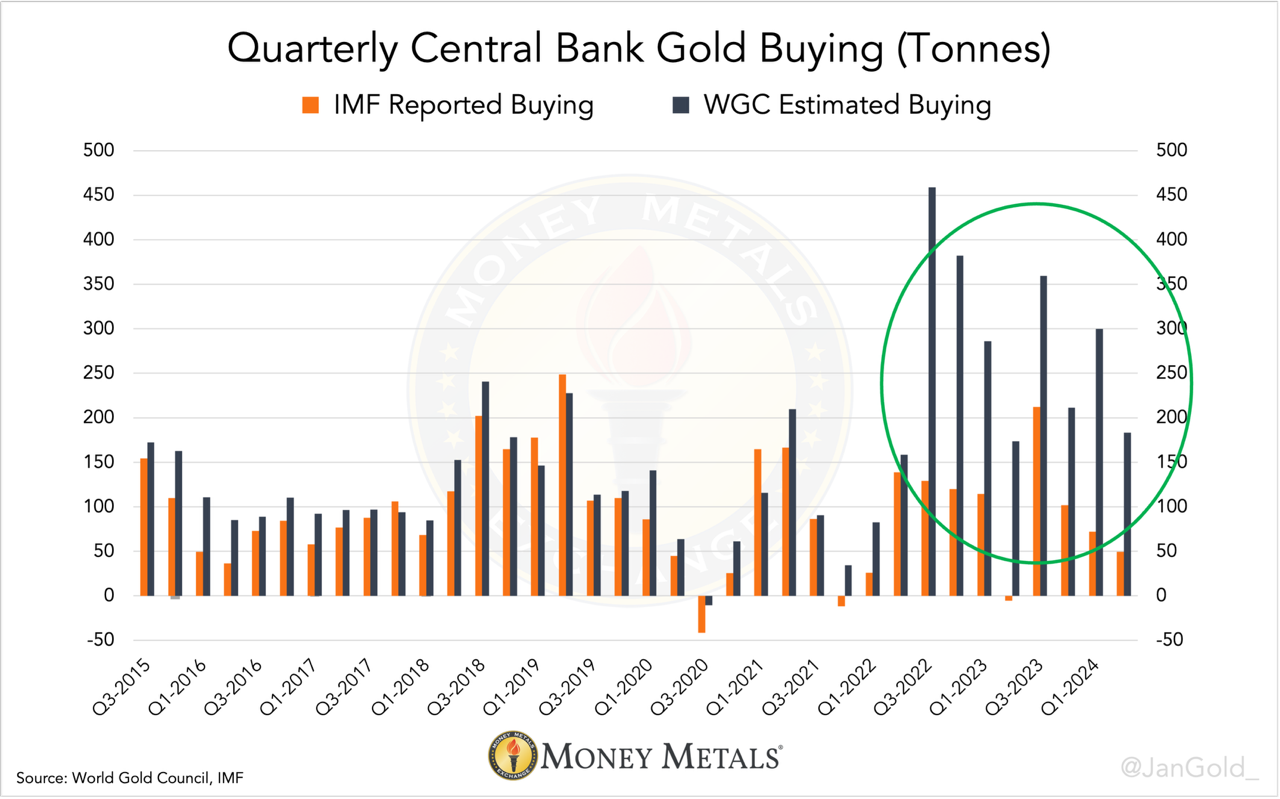

to import gold. The gap between WGC and IMF data reflects unreported purchases.

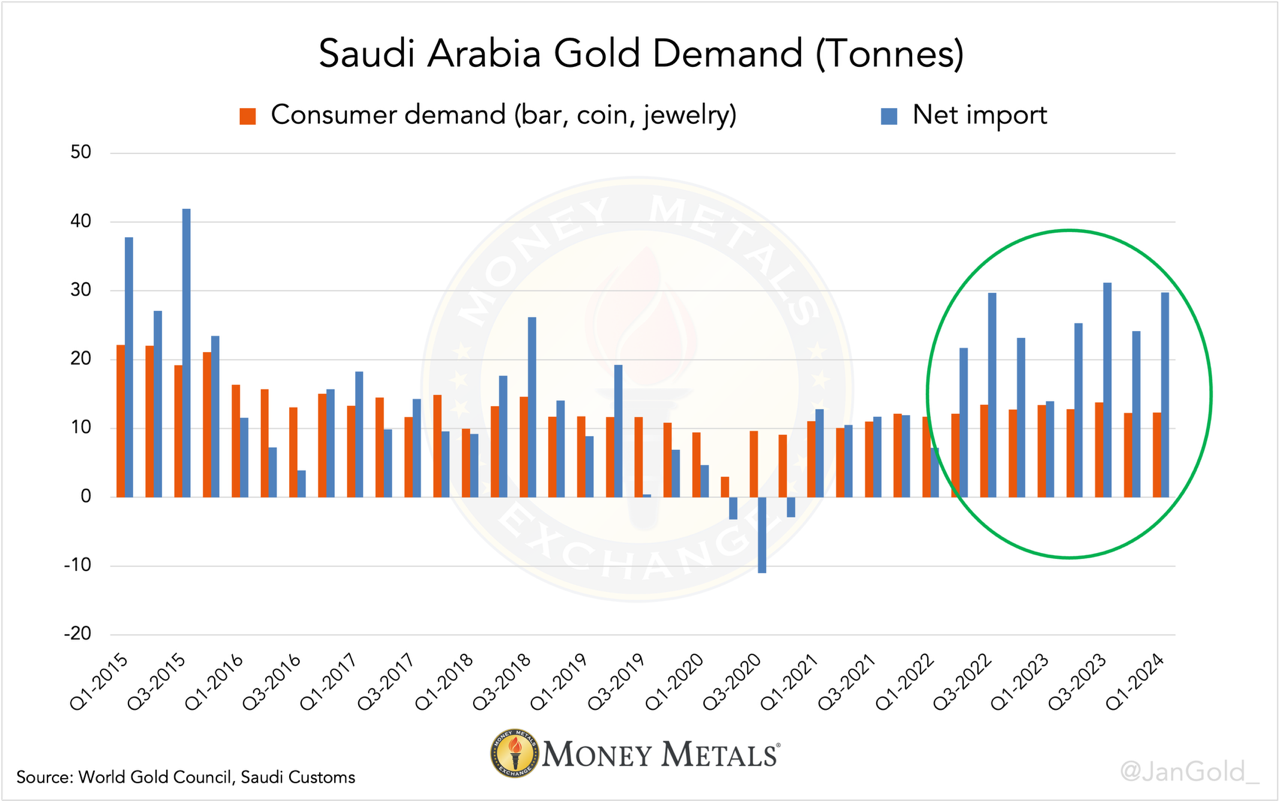

The gap between WGC and IMF data reflects unreported purchases. Discrepancies

between consumer demand and net imports can also arise from dealer

inventory changes and scrap supply, data that is unfortunately not

publicly available.

Discrepancies

between consumer demand and net imports can also arise from dealer

inventory changes and scrap supply, data that is unfortunately not

publicly available. Any

differences between the blue and orange bars is mainly due to scrap

supply, a draw on net imports, which likely was substantial in 2020.

Any

differences between the blue and orange bars is mainly due to scrap

supply, a draw on net imports, which likely was substantial in 2020. Past

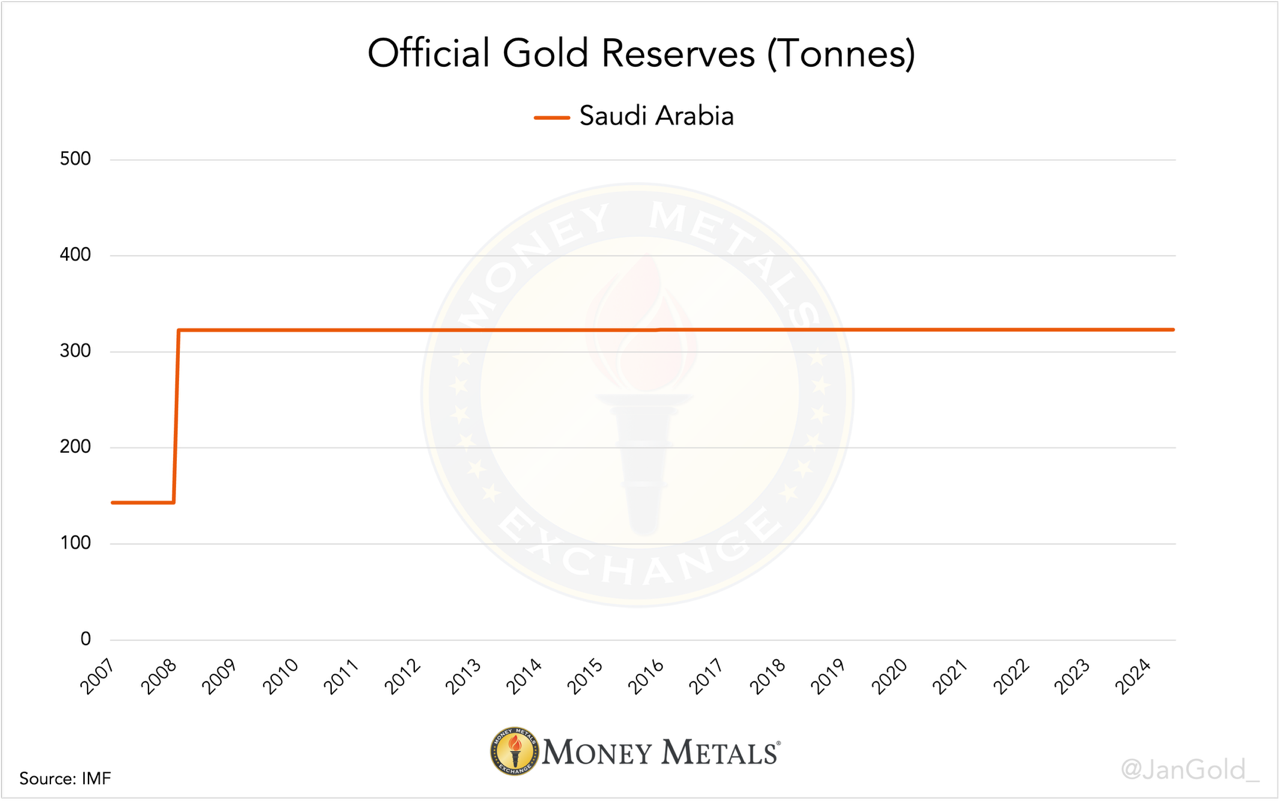

and current data indicate Saudi Arabia central bankers do not report

changes to their gold holdings in a timely fashion. What will their next

bulk update show?

Past

and current data indicate Saudi Arabia central bankers do not report

changes to their gold holdings in a timely fashion. What will their next

bulk update show?