Silver: Emergency Halt of UBS-China Fund Tied to Global Selloff

- on

China Sets The Price Now

GFN – SHANGHAI

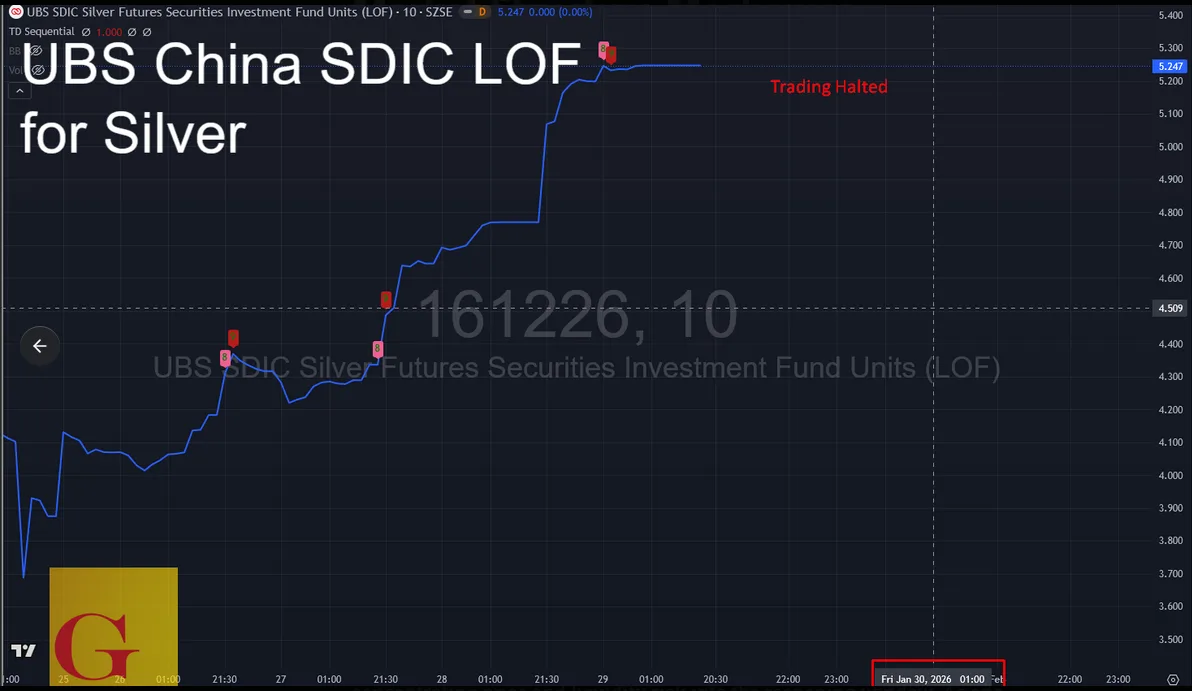

Trading in a major China-listed silver fund was halted for a full session on January 30 as regulators moved to contain price distortions, while global silver prices fell sharply from record highs amid elevated volatility and tighter derivatives margin requirements.

China’s Shenzhen Stock Exchange suspended trading for the entire day on January 30 in the UBS SDIC Silver Futures Fund LOF, according to an official fund announcement. The notice stated that trading would be halted from the market open through the close as part of exchange risk-control measures.

“该基金将于2026年1月30日开市起停牌至收市。”

(“The fund will be suspended from market open to market close on January 30, 2026.”)

— SDIC Silver LOF official announcement, cited by Sina Finance

Chinese financial media reported that the halt followed sustained abnormal trading conditions, with the fund’s secondary-market price diverging materially from its net asset value. Coverage described the suspension as a regulatory response to excessive premiums and repeated risk warnings rather than a change in the underlying structure of the fund.

At the same time, silver prices in international markets recorded one of their largest single-day declines after reaching historic highs earlier in the week. Reuters reported a sharp reversal across precious metals during the January 30 session.

“Gold, silver and copper prices dropped sharply on Friday… Silver dropped 11% to $103.40, after peaking at $121.60.”

— Reuters, Metals Markets Wrap, January 30

Market data showed extreme intraday volatility, with spot silver falling back toward the $100 per ounce level after touching record highs the prior day.

Derivatives market conditions also tightened during the period. CME Group confirmed that it had raised margin requirements on silver futures contracts in response to heightened volatility and rapidly rising prices earlier in January.

“Margins will rise to 11% of notional from the current 9% for non-heightened risk profiles, while heightened risk profile margins will be raised to 12.1%.”

— CME Group margin notice, reported by Mining.com

CME described the changes as routine risk-management adjustments designed to ensure orderly market functioning during periods of exceptional price movement.

The January 30 session combined regulatory intervention in China-listed commodity funds, sharp price corrections in global silver markets, and tighter derivatives margin conditions, all occurring after a rapid, record-setting rally in precious metals earlier in the month.

Market Structure Mechanics

Market participants familiar with exchange-traded commodity products and futures market plumbing highlighted several structural effects stemming from the January 30 fund halt, emphasizing mechanics.

First, industry professionals noted that halting a fund while the underlying commodity continues to trade materially increases risk for fund holders. Traders pointed out that the absence of secondary-market pricing during the session removed the ability of the UBS trader to manage exposure dynamically, concentrating price and liquidity risk into the reopening window. As one derivatives trader put it, the halt “freezes the wrapper, not the asset,” leaving holders exposed to NAV moves they cannot respond to in real time.

Second, sources close to ETF and LOF operations said that such halts interrupt speculative momentum within the fund vehicle itself, particularly when the product has been trading at a significant premium to NAV. By suspending trading, (risk/pseudo) arbitrage and momentum flows are paused, and reopening typically forces a reconciliation between NAV, secondary-market pricing, and redemption demand. Market professionals stressed that this process often reduces speculative excess in the fund, even if it does not alter the underlying commodity’s physical supply and demand.

Third, traders active in futures markets emphasized that freezing the fund while leaving futures markets open can shift adjustment pressure elsewhere. With the fund temporarily non-redeemable, price discovery and risk transfer continue primarily through futures and related derivatives. Several participants noted that this dynamic can accelerate position adjustments in leveraged futures accounts, particularly when margin requirements are rising and volatility remains elevated. But it still does not guarantee the LOF will shrink its NAV premium

One seasoned trader close to the action speculated:

This fund will likely go the way of all funds like PSLV that attract interest.. it will be castrated financially. You are witnessing a stealth global capital control on Silver. Best you not use derivatives.

That trader concluded with: If you want to own silver.. Buy physical. A bird in your hand is worth 2 in the bush.

GoldFix Speculates:

Taken together, and assuming the facts reported are true, industry participants characterize the January 30 actions as possibly necessary from a market-order perspective to bring the fund back toward reasonable trading levels as China’s primary silver exposure vehicle, but structurally asymmetric in execution. By halting the fund while futures markets remained fully active, the adjustment burden was deferred and displaced rather than resolved. The fund’s premium may or may not have been reduced upon reopening com Monday, but during the session itself the broader silver market absorbed the pressure, contributing to a disorderly unwind of leveraged long positions in futures and related instruments.

While communication among international exchanges during periods of stress would not be surprising, the outcome was clear: the market was managed inefficiently in pursuit of fund-level stability, transferring stress outward into global futures markets. If nothing else, the episode reinforces a point long argued by GoldFix since 2023: the Shanghai price is now the global price and that physical is king.