2026年3月7日星期六

2026年3月1日星期日

2026年2月27日星期五

2026年2月26日星期四

India markets regulator changes gold, silver valuation for mutual funds

2月26日(路透社)—印度市場監管機構週四指示,自2026年4月1日起,共同基金應使用國內證券交易所的現貨價格來評估其持有的實體黃金和白銀。

印度證券交易委員會(SEBI)表示,共同基金現在可以使用來自認可的證券交易所的現貨價格,這些交易所結算實物交割的黃金和白銀衍生品合約,以確保估值反映國內市場狀況。

此次變更將不再使用倫敦金銀市場協會(LBMA)的價格來評估交易所交易基金(ETF)持有的黃金和白銀。

2026年2月22日星期日

白銀從來只是伴生礦

白銀供應逾70%嚟自鉛/鋅、銅同金礦副產品,即使2025年價格升160%,供應都唔會急升,數據來自銀業協會2023年報告。

突顯市場依賴基金屬生產,唔受白銀價格主導。

- 儘管工業需求強勁,2026年市場赤字預計達67百萬盎司,為第六年連續赤字,推高價格壓力。

白銀供應來源:

約 30% 來自原生銀礦

約 30% 來自鉛鋅礦

約 14% 來自金礦

約 27% 來自銅礦

2026年2月19日星期四

2026年2月17日星期二

2026年2月15日星期日

紙幣的危機剛剛開始!股市和黃金上漲不是因為經濟增長,而是因為紙幣信用破產!金融風險將長期伴隨我們

現在的世界是一個高風險的世界。金融、社會、戰爭它們之間 是三位一體的關係,牽一髮而動全身。而造成這個高風結構的罪魁禍首,就是萬惡的國家紙幣系統,以及躲在紙幣系統背後的中央銀行、政府和金融機構。

2026年2月12日星期四

金銀幣製作過程

點解實物會有溢價

現貨價(Spot Price)

= 國際交易所的「紙白銀」基準價(大額、即時交割的原料價),主要受投機、期貨、工業需求影響。

實物白銀價(你買到手的銀條/銀幣)

= Spot Price + 溢價(Premium)

溢價主要來自這幾樣:

- 製造、鑄造、包裝成本(熔銀 → 壓條/打幣要錢)

- 運輸、保險、倉儲、分銷成本(銀重,運貴)

- 零售商利潤 + 稅

- 實物供不應求時的「搶貨溢價」(斷貨、瘋搶時最明顯,可去到10–30%+)

最簡單一句總結:

Spot Price 是「原料批發價」,實物價永遠貴啲,因為要把原料變成你手上成品 + 真銀有時真係搶唔到。

2026年2月11日星期三

Ray Dalio 警告CBDC即將來臨

億萬投資者 Ray Dalio 喺 2026 年 2 月 9 日訪問中警告:央行數碼貨幣(CBDC)即將來臨,會消除金融私隱,畀政府權力即時稅收、沒收資金同切斷政治對手嘅資金來源。

- Dalio 作為 Bridgewater Associates 創辦人,

強調 CBDC 雖然高效,但會令政府對個人財務活動有全面監控,類似社會信用系統,可能限制購買力基於碳足跡或政治立場。

- 帖文引發加密社群熱議,回復多推廣私隱幣如 Zcash 同 Monero,視為對抗 CBDC 監控嘅替代方案,反映 crypto 界對金融自由嘅關注。

2026年2月10日星期二

60 Tons of Fake Silver Flood Market! Iron and Lead Inside, China's Largest Gold Market Panic Strikes

Sister Chen, who has worked in Shui Bei for many years, stood behind her counter with a troubled expression. She said, "Lately, 60 tons of fake silver bars have come into the market. Now it is not just about earning money. It is about whether we can stay safe and alive.

2026年2月9日星期一

2026年2月8日星期日

2026年2月7日星期六

Why We Do Not Sell Our Physical

TL; DR

- Stablecoins vs CBDCs is a proxy war over global payment rails.

- BRICS bans on stablecoins are designed to block dollar penetration and accelerate monetary multipolarity.

- The U.S. is turning to stablecoins as a defensive tool to preserve reserve-currency reach without adopting a CBDC.

- Opinion: A mercantilist system is re-emerging, splitting money into 2 types: domestic and international.

Summary: Monetary Supply Chains

Authored by GoldFix

Housekeeping: Presented two ways: Accessible podcast (on site) , and slightly more formal written version below. What looks like a debate about Stablecoin vs. CBDC is really a global struggle for control

“Payment is a monetary supply chain. The world is now contesting that chain, with the U.S. defending the dollar and China advancing the yuan. Gold appreciates inside this conflict as the only truly global settlement asset both sides can use.”

The global debate over stablecoins, central bank digital currencies, and BRICS monetary initiatives is widely misunderstood because it is framed through technical jargon rather than power, control, and incentive structures. At the macro level, stablecoins and CBDCs are policy tools. At the geopolitical level, they are weapons in a contest between a challenged reserve currency and a rising multipolar order. At the secular level, they reflect a return to mercantilism, where nations compete to control payment rails, capital bases, and settlement mechanisms. The fight is not about technology. It is about who controls money, where it circulates, and whose rules govern trade.

Cutting Through the Terminology Fog

The current monetary discourse is saturated with overlapping and often contradictory language. Stablecoins, CBDCs, tokenized money, digital rails, programmable currency. The terminology itself obscures the underlying dynamics.

“If this soup of terminology is seemingly confusing, well, if you take a look at it from a macroeconomic perspective it will make sense. But if you take a look at it from a geopolitical, secular perspective, a mercantile perspective, it makes a lot more sense.”

The confusion is not accidental. Much of the debate focuses on surface-level mechanics while avoiding the structural motivations behind policy choices. When framed properly, the behavior of the United States, China, and the BRICS bloc follows a coherent logic.

The Macro: Policy Tools and Stated Intentions

At the macroeconomic level, the discussion centers on rules, policies, and official justifications. Governments explain their actions in terms of consumer protection, financial stability, and monetary sovereignty.

From this vantage point, the United States seeks to maintain its position as issuer of the global reserve currency. One adaptation under consideration is the expansion of dollar-based stablecoins. These instruments allow the dollar to move more easily across borders and into jurisdictions where direct dollarization would face resistance.

“Stablecoins are a sugar-coated wrapper that makes it easier to swallow the bitter pill of U.S. dollar dependency, especially for smaller countries.”

In response, many nations either ban stablecoins outright or restrict them unless issued under domestic authority. The stated solution is the adoption of central bank digital currencies, which are framed as tools to protect citizens and preserve national monetary systems.

At this level, the narrative appears fragmented. Some countries ban stablecoins. Others encourage them. Some experiment with CBDCs. Others delay. Taken only at face value, the policy landscape looks inconsistent.

Geopolitical: GRC Status Versus Multipolarity

Zooming out reveals coherence. What appears fragmented at the policy level resolves into a contest between two opposing monetary objectives.

On one side stands the incumbent global reserve currency. On the other stands a coalition seeking multipolarity.

“What the BRICS are really doing by banning stablecoins and adopting CBDCs is shutting the dollar out. They want their currencies to float economically and discover their own value.”

BRICS initiatives such as cross-border settlement platforms, bilateral trade arrangements, and large-scale gold accumulation are not isolated projects. They are components of a broader strategy to reduce reliance on the dollar-centered system.

This shift places the dollar on the defensive. Stablecoins become a countermeasure. They allow the dollar to retain relevance even as formal banking and settlement channels fragment.

“It is BRICS versus the United States. Multipolarity trying to assert itself and the incumbent reserve currency trying to protect its position.”

At this layer, stablecoins and CBDCs cease to be neutral technologies. They become instruments of strategic competition.

Structural Layer: Mercantilism Returns

Zooming out again reveals the deepest framework. The global economy is transitioning away from globalism toward regionalization. As trade blocs harden, so do monetary zones.

“The world is split in two. The world is regional. And as a regional world breaks down from globalism, you are going to have regional currencies.”

In such a system, nations prioritize control over capital flows, tax bases, and internal demand. This is mercantilism in modern form. Digital money simply accelerates and formalizes the process.

China’s opposition to stablecoins follows directly from this logic. Dollar-linked stablecoins represent an injection of foreign monetary influence into the domestic economy.

“To use dollars at the retail level is to replace the currency of the nation slowly and surely from the inside out.”

CBDCs, by contrast, lock capital within national systems. They reinforce domestic control while enabling selective engagement externally.

The United States approaches the problem from the opposite position. As the dominant issuer, it benefits from global circulation of its currency. If traditional mechanisms weaken, alternatives must be developed.

“If the U.S. cannot maintain its global reach with its currency as it currently stands, then it needs to adapt to what BRICS are doing.”

Stablecoins become the adaptation layer. Even without adopting a formal CBDC, stablecoins can replicate many of the same control functions domestically while preserving private-sector intermediaries.

“Stablecoins will serve the same purpose as CBDCs for U.S. citizens, just run by private companies. And there’s your corporatism.”

Bifurcation of Money: Domestic Use Versus International Settlement

As mercantilism reasserts itself, money bifurcates by function.

Domestically, nations deploy digital currencies to manage taxation, compliance, and internal stability. Internationally, different instruments emerge to settle trade and sovereign obligations.

“You are going to have money that you use to buy things, and then you are going to have money that you use to settle international debts.”

In parts of the East, this may involve CBDCs paired with gold-linked settlement mechanisms. In the West, it may involve stablecoins layered atop existing financial infrastructure.

This division mirrors historical mercantilist systems where trade settlement and domestic circulation operated under different rules.

Payment Rails as the True Battleground

At the core of this entire transition lies one concept.

“Payment rails are the things that people use to settle their trades.”

Payment rails determine whose currency is used, whose rules apply, and whose system captures transaction data and fees. They are fragmenting globally.

有史以來第一次,全球數據顯示連續兩年黃金新發現數量為零。

https://x.com/tavicosta/status/2019866206807945228?s=46&t=rt3XmYmqG_eB8lRu6xQtZg

這種情況前所未有。

而且,這並非黃金獨有的現象。

大多數金屬的重大新發現數量都已降至個位數,目前沒有任何具有實質改變全球供應曲線的在建項目。

這才是衡量我們目前所處礦業週期階段的真正晴雨表。

現在還處於早期階段。

2026年2月6日星期五

2026年2月5日星期四

2026年2月4日星期三

2011年愛潑斯坦電郵曝光:中國若棄美元掛鉤轉向黃金,誰將提前布局?

2011年9月9日晚上11點01分,一封看似普通的電郵被發送到Jeffrey Epstein(中文常譯為「傑弗里·愛潑斯坦」)的私人郵箱 jeevacation@gmail.com。寄件人身分目前仍被部分遮蓋,但內容卻直白得令人震驚:

「我們應該研究一下這種可能性,以及如果中國決定放棄貨幣與美元的掛鉤,改用黃金作為替代,該如何從中賺錢。」

這句話出自13年前,當時全球金融市場仍處於2008年金融海嘯後的餘波,美元作為世界儲備貨幣的地位看似牢不可破,人民幣對美元的「盯住式」匯率機制(俗稱「盯住美元」或「美元掛鉤」)也仍是中國外匯政策的核心支柱。誰能想到,一個以性犯罪醜聞聞名的金融圈人物,竟在私下討論如此宏觀且具顛覆性的地緣貨幣議題?

背景:2011年的中美貨幣博弈

2011年,中國已是全球第二大經濟體,持有超過3萬億美元的外匯儲備,其中大部分是美國國債。人民幣匯率長期被美國指責「人為低估」,中美之間的「貨幣戰」爭論不休。同一時期,黃金價格正處於歷史高位(2011年9月金價一度衝上1,900美元/盎司以上),不少投資者已開始質疑美元的長期信用。

愛潑斯坦這封電郵的時間點非常微妙:

- 剛好在全球對美元霸權的質疑聲浪升高之際

- 中國央行當時正悄悄增加黃金儲備(雖然公開數據增長緩慢,但市場一直有「隱藏買盤」的傳聞)

- BRICS(金磚國家)概念已成型,開始醞釀挑戰西方主導的金融秩序

他不是在談道德或地緣政治,而是赤裸裸地問:「如果中國真的這麼做,我們怎麼賺錢?」

這封電郵意味什麼?

- 精英圈早已預見「去美元化」

愛潑斯坦的社交圈包括政商學界頂層人物。這封電郵顯示,至少在2011年,某些具影響力的人士已經認真考慮「人民幣脫鉤美元、轉向黃金本位(或部分黃金支持)」的可能性,並開始盤算如何從中漁利。這不是陰謀論,而是赤裸的資本邏輯:當貨幣體系可能發生結構性轉變時,先知先覺者總想搶先卡位。 - 黃金在今天重回聚光燈

2025–2026年間,隨著BRICS擴大、人民幣國際化加速、中國持續增持黃金、甚至傳出「金磚貨幣」或「黃金結算」概念,當年那句「用黃金代替」的假設已不再是空想。金價屢創新高,央行買金熱潮持續,美元信用正面臨多重挑戰。回頭看這封2011年的電郵,簡直像預言。 - 誰是真正的「玩家」?

愛潑斯坦本人並非貨幣專家,他更像一個「連接者」——把各種資源、人脈、資訊串聯起來。這封電郵或許不是他一個人的想法,而是他與某位金融圈、金屬圈或地緣政治圈人士討論後的結論。被遮蓋的寄件人身分,或許才是關鍵線索。

結語:歷史總在重演,只是參與者換了面孔

今天我們看到的是:央行拋售美債、增持黃金、數位貨幣試點、跨境黃金結算……這些動作,早在13年前就有人在私下盤算「怎麼賺錢」。當全球貨幣秩序真的走向轉型時,那些最早看到方向的人,往往已默默完成布局。

愛潑斯坦或許因罪行身敗名裂,但這封電郵卻意外成為一個時代註腳:

當權力、金錢與地緣政治交織時,有人永遠在問同一個問題——「我們怎麼從中賺錢?」

2026年2月3日星期二

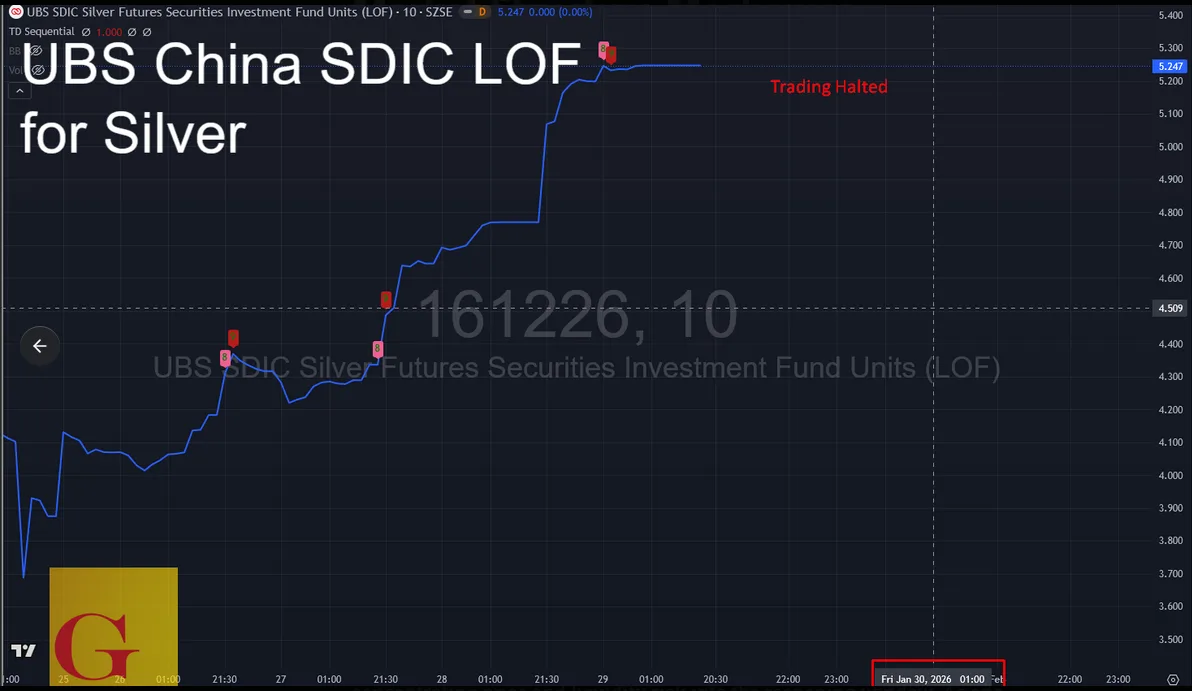

白銀:瑞銀-中國基金緊急停止與全球拋售有關

Silver: Emergency Halt of UBS-China Fund Tied to Global Selloff

- on

China Sets The Price Now

GFN – SHANGHAI

Trading in a major China-listed silver fund was halted for a full session on January 30 as regulators moved to contain price distortions, while global silver prices fell sharply from record highs amid elevated volatility and tighter derivatives margin requirements.

China’s Shenzhen Stock Exchange suspended trading for the entire day on January 30 in the UBS SDIC Silver Futures Fund LOF, according to an official fund announcement. The notice stated that trading would be halted from the market open through the close as part of exchange risk-control measures.

“该基金将于2026年1月30日开市起停牌至收市。”

(“The fund will be suspended from market open to market close on January 30, 2026.”)

— SDIC Silver LOF official announcement, cited by Sina Finance

Chinese financial media reported that the halt followed sustained abnormal trading conditions, with the fund’s secondary-market price diverging materially from its net asset value. Coverage described the suspension as a regulatory response to excessive premiums and repeated risk warnings rather than a change in the underlying structure of the fund.

At the same time, silver prices in international markets recorded one of their largest single-day declines after reaching historic highs earlier in the week. Reuters reported a sharp reversal across precious metals during the January 30 session.

“Gold, silver and copper prices dropped sharply on Friday… Silver dropped 11% to $103.40, after peaking at $121.60.”

— Reuters, Metals Markets Wrap, January 30

Market data showed extreme intraday volatility, with spot silver falling back toward the $100 per ounce level after touching record highs the prior day.

Derivatives market conditions also tightened during the period. CME Group confirmed that it had raised margin requirements on silver futures contracts in response to heightened volatility and rapidly rising prices earlier in January.

“Margins will rise to 11% of notional from the current 9% for non-heightened risk profiles, while heightened risk profile margins will be raised to 12.1%.”

— CME Group margin notice, reported by Mining.com

CME described the changes as routine risk-management adjustments designed to ensure orderly market functioning during periods of exceptional price movement.

The January 30 session combined regulatory intervention in China-listed commodity funds, sharp price corrections in global silver markets, and tighter derivatives margin conditions, all occurring after a rapid, record-setting rally in precious metals earlier in the month.

Market Structure Mechanics

Market participants familiar with exchange-traded commodity products and futures market plumbing highlighted several structural effects stemming from the January 30 fund halt, emphasizing mechanics.

First, industry professionals noted that halting a fund while the underlying commodity continues to trade materially increases risk for fund holders. Traders pointed out that the absence of secondary-market pricing during the session removed the ability of the UBS trader to manage exposure dynamically, concentrating price and liquidity risk into the reopening window. As one derivatives trader put it, the halt “freezes the wrapper, not the asset,” leaving holders exposed to NAV moves they cannot respond to in real time.

Second, sources close to ETF and LOF operations said that such halts interrupt speculative momentum within the fund vehicle itself, particularly when the product has been trading at a significant premium to NAV. By suspending trading, (risk/pseudo) arbitrage and momentum flows are paused, and reopening typically forces a reconciliation between NAV, secondary-market pricing, and redemption demand. Market professionals stressed that this process often reduces speculative excess in the fund, even if it does not alter the underlying commodity’s physical supply and demand.

Third, traders active in futures markets emphasized that freezing the fund while leaving futures markets open can shift adjustment pressure elsewhere. With the fund temporarily non-redeemable, price discovery and risk transfer continue primarily through futures and related derivatives. Several participants noted that this dynamic can accelerate position adjustments in leveraged futures accounts, particularly when margin requirements are rising and volatility remains elevated. But it still does not guarantee the LOF will shrink its NAV premium

One seasoned trader close to the action speculated:

This fund will likely go the way of all funds like PSLV that attract interest.. it will be castrated financially. You are witnessing a stealth global capital control on Silver. Best you not use derivatives.

That trader concluded with: If you want to own silver.. Buy physical. A bird in your hand is worth 2 in the bush.

GoldFix Speculates:

Taken together, and assuming the facts reported are true, industry participants characterize the January 30 actions as possibly necessary from a market-order perspective to bring the fund back toward reasonable trading levels as China’s primary silver exposure vehicle, but structurally asymmetric in execution. By halting the fund while futures markets remained fully active, the adjustment burden was deferred and displaced rather than resolved. The fund’s premium may or may not have been reduced upon reopening com Monday, but during the session itself the broader silver market absorbed the pressure, contributing to a disorderly unwind of leveraged long positions in futures and related instruments.

While communication among international exchanges during periods of stress would not be surprising, the outcome was clear: the market was managed inefficiently in pursuit of fund-level stability, transferring stress outward into global futures markets. If nothing else, the episode reinforces a point long argued by GoldFix since 2023: the Shanghai price is now the global price and that physical is king.

2026年2月2日星期一

2026年2月1日星期日

中國金銀實物定價與國際價脫鈎

全球貴金屬期貨價格急挫(黃金約5075美元/安士,銀約99美元/安士),但中國京東平台實物金銀條價格維持高位(黃金5720美元/安士,銀163美元/安士),顯示中國實物需求強烈。

- 金條溢價約13%,銀條高達65%,反映實物市場脫離紙上交易,可能因經濟不確定性令投資者囤積實物。

- 回覆討論COMEX價格同中國零售價差距,部分用戶視西方市場為「假價」,突顯全球貴金屬定價分歧。

白銀40年來閃崩35%暴跌

Here is the full explanation of how the biggest exploit in the history of precious metals likely unfolded 👇🏻

Comex futures price settlement at the Comex is based on a VWAP between 13:24 to 13:25EST

LBMA price settlement instead happens at 12:00 UK time

Most of Silver OTC contracts settle using the LBMA reference and many OTC contracts expire into month end.

On the 30th Jan LBMA silver price benchmark settled at 103.19$ while the Comex Benchmark a few hours later settled at 78.29$.

The following chart (credit @KingKong9888 ) is a great representation of how bullion banks hedge and transact in the silver market (both paper and physical).

It is an open secret now how many banks and brokers were under water on their silver positions, gold and other precious metals especially after the rally in January. Beware this flow chart roughly applies to all these metals that all crashed on Friday (not silver alone).

What’s even more remarkable is how precocious metals crashed on Friday in isolation, stocks, bonds and other commodities were totally unaffected. Anyone that understands any basic of macro and markets knows how this is logically wrong.

Let’s add one more piece to the puzzle now: on Friday the OI at the Comex decreased by 8k contracts at the end of the day. Assuming for simplicity the price differential between the LBMA and the Comex as a reference. That means banks were able to extract ~1bn$ gain from their shorts pushing the Comex price through the floor after the LBMA settlement.

Furthermore the $SLV continued trading after the LBMA benchmark settlement creating almost a 20% discount to NAV because of that. Here is the other trick the banks pulled. If you have to settle a lot of physical contracts at the LBMA but you don’t have the metal, because of such a discount to NAV, AP banks could buy $SLV shares in the open market from panic selling investors, tender the shares to claim bars at 103.19$ and make a killing in the process.

Not surprisingly, $SLV shares count increased by ~51m shared from Thursday to Friday according to iShares. Because of the NAV discount banks extracted up to 1.5bn$ of profits exploiting this ETF assuming they bought up all that shares differential and then turned around to claim silver bars at a much higher price for contract settlement purposes (keep an eye on the data on the metals redemption from the ETF).

The last piece of the puzzle is the exploit against Leveraged silver ETFs like $AGQ that have been forced into liquidating a vast number of derivative contracts during the crash. Here brokers made a killing too, but other people here on X already covered this matter well so no need for me to say more.

All in all, it’s fair to estimate how banks and brokers made up to 5bn$ of profits (or lowered their pre existing losses depending on how you look at it) orchestrating one of the biggest price manipulation in the history to abnormally crash the price of silver in a single day. Surely they made more if you consider the same dynamics happened on gold platinum and palladium.

However this left the precious metals market in a massive price dislocation not only between physical and paper, but also across financial products and exchanges.

Trading resumes in less than 24 hours and there is a chance that what’s about to happen is going to be even more historic than Friday’s events because China and India won’t stop buying silver because of the severe industrial shortage they are dealing with.